Australia's new boom: human beings

It’s perfectly clear what is now taking over as the main driver of Australia’s economic growth: population.

In the 1990s, it was the productivity growth that resulted from the microeconomic reforms of the Hawke Government. In the 2000s, it was the increase in commodity prices resulting from Chinese demand.

Productivity growth finished long ago, and the investment boom is coming to an end now. Although mining and energy exports will continue to support GDP, the burning question is: what will replace resources investment as the new driver of growth?

The answer is people, or more specifically, the infrastructure required to house, feed and transport them.

Last year Australia’s population grew 1.8 per cent -- the most in the Western world. As a direct result of that, as well as a rebirth of real estate investment as confidence and lending picked up, the national median house price rose 10 per cent last year and then further accelerated in March to 2.3 per cent in the month -- the highest monthly growth rate on record.

There are legitimate concerns that house prices are rising too fast and may eventually fall just as quickly. But for the moment, rising prices are supported by fundamentals and are in turn supporting consumer and business spending.

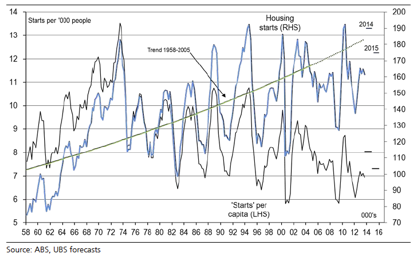

Housing construction is booming. Housing starts have been averaging 150,000-160,000 a year for a decade, but approvals have now kicked up to an annual pace of 210,000.

At the same time, per capita housing starts have been trending down for 40 years and are still falling, as this chart shows:

Last year Australia’s GDP grew by 2.3 per cent. Subtract the effect of population growth and it was just 0.5 per cent, one of the weakest in the world.

In most other Western countries, the situation is reversed: population is barely growing or actually declining.

Over the past 12 months, Australia’s consumer spending growth was zero in per capita terms -- in other words, the entire increase in consumption last year was due to extra people.

Where are most of them coming from? New Zealand.

The great irony is that while the government sternly closes the front door to boat arrivals, the back door is wide open for Kiwis. Last year 25,000 of the buggers arrived, compared with 20,000 Chinese and 20,000 Indians.

It seems likely that Chinese arrivals will overtake those from New Zealand this year because the revival of the so-called business migration scheme, where someone can buy their way in for $5 million. Many more Chinese citizens have that sort of money than Kiwis.

The education sector is also recovering after a dreadful few years. Student commencements are now growing at 10 per cent, having shrunk 10 per cent a year between 2010 and 2013.

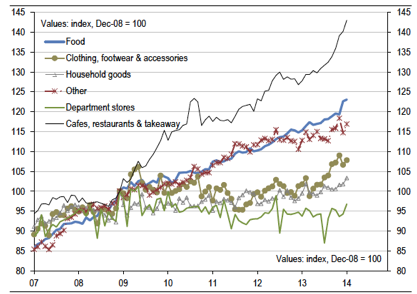

Australia’s boom in human beings is not only flowing through to a boom in housing construction and house prices, but retail sales also rose sharply in January (1.2 per cent and 6.2 per cent year on year). By far the fastest growing component is cafés and restaurants.

In fact, it’s fair to say that restaurants, food, and to some extent clothing are responsible for the entire lift in retail sales.

Retail sales

Source: UBS

Unlike China, which must now deal with a glut of housing and infrastructure, Australia has a shortage of both.

So thanks to Australia’s population boom, it’s a fair bet that non-mining construction -- housing, retail, transport -- will take over from resources construction as the key driver of Australian economic growth.

The Reserve Bank doesn’t trust it yet, as shown by the caution in yesterday’s monetary policy statement (“signs of improvement in investment intentions in other sectors are only tentative, as firms wait for more evidence of improved conditions before committing to expansion plans”).

But the government is showing much more confidence in the economy, with Treasurer Joe Hockey travelling the country telling us all how much he’s going to be cutting from the budget.

He’s probably doing the old over-promise and under-deliver (or should that be the other way around?) but there appears to be no concern in Canberra -- unlike in Martin Place -- that a bout of fiscal austerity will damage the fragile recovery.

Perhaps that’s because they know what’s going on with population growth and are, in fact, using it as an economic growth and labour market reform strategy, just as John Howard and Peter Costello did. More migrants means a greater supply of workers and less pressure on wages and conditions and less power for unions.

But it also means more building, which is why it is so important to break CFMEU’s hold on the construction industry.

Without that, the new boom in city infrastructure needed to cope with the increase in population will simply lead to higher costs. Its impact would be negated by making Australia less competitive, leading to higher interest rates to deal with inflation.