Australia - China's solar dumping ground

It now seems reasonably likely that the European Union will impose import duties on Chinese solar modules of 47 per cent. This joins a similar action by the US where tariffs of 31 per cent were imposed on major manufacturers Trina and Suntech, but also a whopping 249.96 per cent tariff on most other Chinese manufacturers using Chinese solar cells (the main sub-component of a complete solar panel or module).

This is likely to mean one thing for Australia – lots of cheap Chinese panels are headed this way.

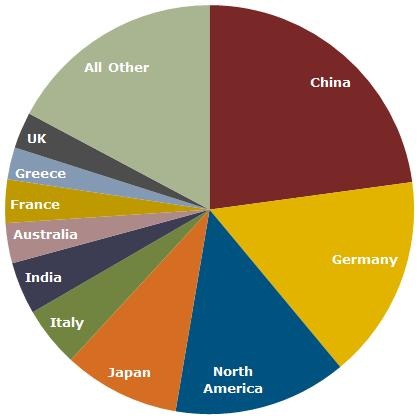

If you look at the global breakdown of solar PV demand (pie chart below), Chinese manufacturers are running out of options. Sure the Chinese market is now expected to be the biggest in 2013, but it’s only 7GW when Chinese production capacity could supply the entire world’s 30GW of demand.

Geographic breakdown of global PV demand in 2013

Source: NPD Solarbuzz Marketbuzz 2013

So let’s then look down the order.

-- Number 2 Germany: could have a 47 per cent tariff shortly.

-- Number 3 North America (largely United States): 31 per cent to 249 per cent tariff. US-headquartered producers SunPower and First Solar have pushed aside the Chinese producers to take top spots as leading suppliers to this market. So far China has used Taiwanese solar cells to sidestep US tariffs, but Taiwan’s capacity isn’t big enough to cope with Europe as well.

-- Number 4 Japan: fast growing market with no trade tariffs but fiercely loyal to domestic suppliers. Japanese brands of Sharp, Kyocera, Panasonic, and Solar Frontier have outperformed Chinese competitors over last few quarters.

Of the rest of the countries big enough to be named, only Australia and India lie outside of Europe’s 47 per cent tariff. And even if Chinese suppliers were to capture all the countries marked “all other”, they’d still have a huge overhang of excess production capacity.

In discussing the potential implications of the European tariff with industry participants, Nigel Morris, of SolarBusinessServices, provided an interesting observation from a recent solar industry conference he attended. He went around to each of the trade show supplier booths asking them their motivation and strategy for entering the Australian market. A common response from several panel manufacturers (predominantly tier-2 and tier-3 solar manufacturers) was along the lines of:

‘We can’t sell in the US anymore and we expect barriers to go up in Europe so we hope to sell a lot more in Australia where it is very easy to access the market.’

A few months ago I predicted solar module prices would begin rising, and it appears that has started to occur. But if Europe proceeds with its proposal for a 47 per cent tariff, module prices in Australia may drop precipitously as the Chinese desperately try to offload stock.