Are we being too optimistic on Tesla?

Tesla Motors and its chief executive Elon Musk can seemingly do no wrong, at least in the eyes of investors.

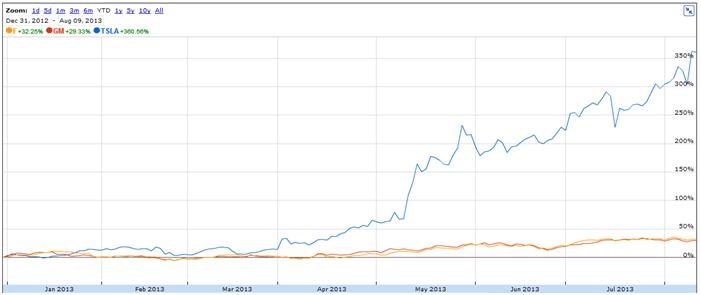

The company’s stock is hovering near $US150 a share, around four times where it began the year.

When it topped $50 back in April, people expected a pullback. It didn’t come. It then cleared $100 and analysts lined up to warn of an imminent correction. It didn’t last. Now the multi-billion dollar question is: can it keep rolling past $150?

The rapid price rise sees Tesla with a market capitalisation of over $US18 billion. To put that in perspective, on current exchange rates it would rank the 13th largest group on the Australian Securities Exchange, were it listed here. It also sees it valued at over a third of General Motors and more than 25 per cent of Ford. Not bad for a company that released its first car just five years ago.

Tesla share price performance YTD versus American peers GM and Ford. Source: Google Finance.

The progress is undoubted. From the company’s first ever quarterly profit, to an unexpected follow-up profit in the second quarter, ratings on the flagship Model S above all comers (not just electric peers) and raising bucketloads of cash on a whim.

Its triumphs are not going unnoticed by the big players in the sector. General Motors, while aware that current sales of Tesla’s flagship Model S pose little threat to its business, has assigned a small group to study the Musk-led company. The group from GM is tasked with assessing whether Tesla could prove a gamechanger.

"History is littered with big companies that ignored innovation that was coming their way because you didn't know where you could be disrupted," GM Vice Chairman Steve Girsky told Bloomberg.

"It's fascinating. I don't know if it's going to work or not work. All I know is if we ignore it and say it's a bunch of laptop batteries, then shame on us."

Musk responded on Twitter with typical good humour.

"Oh yeah, well Tesla will study a plan to study the GM team that's studying Tesla, so there!”

It’s the kind of response you would rarely hear from the CEO of a publically listed multi-billion dollar group and that is part of his success.

He also delivers honest assessments in such a way that investors feel comfortable, such that he is probably the only chief executive in the world who could get away with saying his company had been “dumb” in its approaches.

“In the fourth quarter of last year, we were extremely dumb at making cars. In the first quarter, we were, maybe, still pretty dumb. (laugh) And [we were] slightly dumb in the second quarter. And, hopefully by the fourth quarter, we will at least not be dumb…” he said, according to CleanTechnica.

It shows an understanding that Tesla has a lot of improvement, with Musk acutely aware the carmaker has a number of issues to counter, including:

1) Its current profit is largely down to selling zero emissions credits to rival automakers.

2) It is valued on 200 times earnings, meaning expectations are sky high.

3) It has not yet cracked the code for an affordable, high quality electric car – and if it does, will it damage the brand name?

The elephant in the room is the latter – that of branding. Tesla Motors is confident of producing a $US35,000 electric car for the masses, but would it still carry the Tesla name?

Right now the brand of Tesla is somewhat equivalent to a Mercedes. In fact it’s probably stronger, more akin to Apple whereby there is a large group of followers on the edge of their seat to upgrade to the next innovation and a core group intrigued by what could be next. Both Mercedes and Apple, however, don’t go down market.

If Mercedes used its name to do so it would likely lose its market in the luxury segment. This begs the question: If Tesla puts its name to a $35,000 car – regardless of how good it is – does it tarnish the aspirational view of the brand such that its ability to sell luxury cars whittles away?

And if it does, would it matter so long as you sell plenty of the affordable option?

As for the valuation, the metrics are largely irrelevant with a company like Tesla.

On the surface it is overvalued to an incredible degree. A company that sells just over 20,000 cars a year and on a price to earnings ratio in the hundreds (the long-term market average is around 15) should be worth a fraction of its current price. But investors are seeing a company that could be a key cog in the future of the automotive sector. They are witnessing the rapid development of new technology that could reshape the way we drive. However, if it fails to meet ever growing expectations at any time in the next 12 months, it is priced such that its share price will get hammered.

Investors are banking on Elon Musk – who last week outlined his innovative Hyperloop transport option – to be the next Henry Ford. He very well could be, and with a market capitalisation of $18 billion, he almost needs to be.