Amazon and the Aussie hit list

This Special Report was originally published in June 2017. Amazon officially launched in Australia on 5 December.

While Amazon claimed its Australian online store launch was its biggest ever, many customers were underwhelmed by the product range and discounts. Our special report remains just as relevant today because it will take years for Amazon to achieve the market share it enjoys in other countries.

The rollout will be staggered, with services such as Amazon Prime and Amazon Fresh still some time away. What was clear from Amazon's launch was that Australian retailers have already been preparing - we'll find out just how well in the years ahead.

Why is Amazon so formidable?

In 2015, Amazon became the fastest company ever to reach US$100bn in sales. It accounts for more than half of online sales growth in the US – and about 5% of total retail spending – so it's clearly doing a lot right.

Amazon started as an online bookseller but it's now much more than that. Not only does it retail general merchandise itself, it operates Marketplace, a platform that allows third party sellers to sell new or used products. It offers a membership program called Prime, which packages up free delivery with a range of entertainment options. And it operates Amazon Web Services, a cloud computing service offered mainly to businesses.

With Amazon finally launching in Australia, local retailers are worried. While Amazon already makes sales of around $1bn here, the online retailer – an increasingly inaccurate description – has reportedly signed a lease for a purpose-built warehouse in Sydney. Warehouse facilities mean Amazon will be able to stock – and quickly deliver – a far wider range of merchandise. So how much of a threat does Amazon pose to ASX-listed retailers?

Key Points

- Amazon entering Australia shortly

- Retail landscape will change

- Some retailers likely to suffer

Quite a lot, at least for some. In this three-part series, we'll start by considering what makes Amazon so formidable. In part two, we'll examine Amazon's likely effect on selected ASX-listed specialty retailers. And in part three, we'll conclude by looking at how Woolworths and Wesfarmers might cope.

So why is Amazon causing Australian retailers to quake in their boots?

The customer is king

Well, Amazon aims to be ‘Earth's most customer-centric company'. If it were any other company, this rather grandiose aim might ring hollow – but Amazon lives its mission statement.

Jeff Bezos, the company's founder and chief executive, has said that ‘Percentage margins are not one of the things we are seeking to optimise'. More famously – and ominously – he has said to his competition: ‘Your margin is my opportunity'. While competitors usually prioritise profit, Amazon aims to make life better for customers. Earnings aren't particularly relevant – at least in the short term.

| Jeff Bezos is an impressive chief executive. We recommend you read his letters to shareholders at the front of each Amazon annual report. You'll learn a lot about business in general (they're shorter than Berkshire Hathaway's, too). |

While you might know Amazon for books or its Kindle e-reading device, perhaps the most important thing the company sells in the US is convenience. For US$99 a year, Amazon Prime offers free two-day shipping and a significant range of entertainment options (including unlimited video and music streaming). In some areas you can get free two-hour delivery on a range of items.

As a result, more than 60% of American households now have a Prime membership. Bezos has said Prime is ‘such good value, it would be irresponsible not to be a member'. It's hard to disagree.

Virtuous circle

Also important, of course, are low prices. Amazon undercuts retail competitors because profitability isn't a key measure. This feeds a virtuous circle: cheap prices, free delivery and Amazon's omnipresence cause customers to order again and again. Increasing size then allows the company to reduce prices and add even more services.

All this is combined with innovation and technology. Amazon uses algorithms to make personalised recommendations based on past ordering behaviour, as well as to price merchandise just below that of competitors (which makes it hard to match prices). It's currently trialing ‘just walk out' stores as well as futuristic concepts like drone delivery (although drones looks some way from becoming a mainstream option). And that's just the beginning.

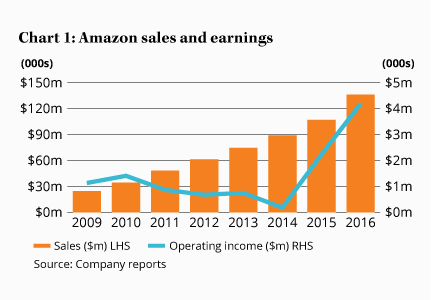

Only a few years ago Amazon was famous for surging sales but negligible earnings. Not any more. Chart 1 shows that, while the virtuous circle has continued to drive sales upwards, earnings have also taken off over the past two years.

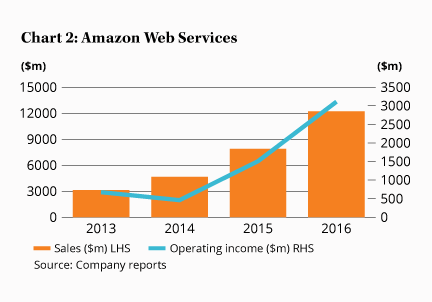

But Amazon's retailing business hasn't suddenly become much more profitable. Rather, Chart 2 shows the phenomenal recent growth from its high margin cloud computing service Amazon Web Services (AWS). This division now accounts for almost 75% of Amazon's earnings. AWS's strong performance, coupled with accelerating sales growth elsewhere, explains why Amazon's share price has almost tripled since 2014.

The fact that Amazon now generates US$80bn of sales in the US is also important. While the company might account for only 5% of total American retail spending, it's now of such a size that it is taking an increasing share of the pie. That spells bad news for many existing retailers.

Going, going, gone

Already online retailing has been blamed for killing off bookstores like Borders, Waterstones and Angus & Robertson, consumer electronics chains like Circuit City in the US and music chains such as HMV in the UK. Amazon has of course facilitated this shift, although it's not solely responsible.

Now US department stores are feeling the pressure. In the most recent quarter, Macy's, JC Penney and Sears reported that same-store sales fell by 5%, 4% and 12% respectively. Each has announced it will close more than 100 stores. Specialty retailers are suffering too, particularly as people are spending less on clothing and more on experiences.

All this is having a magnifying effect across the US, which is widely regarded as having built too many ‘malls'. The US has double the amount of shopping centre floor space per person compared with Australia, and five times as much as the UK. As the lower quality US malls lose tenants, foot traffic falls and a downward spiral accelerates.

It's no wonder local retailers are petrified the same thing might happen here.

With competitors falling away, soaring sales, a visionary chief executive and cutting-edge technology, Amazon has certainly captured the zeitgeist. It's easy to fall for the Amazon story, precisely because it's an impressive one. The market thinks so too; Amazon's share price values the company at twice that of Walmart, even though the latter has more than three times the revenue.

The shipping news

Yet we can imagine multiple ways Amazon's retail model might eventually begin to struggle. Chief among them is rapidly escalating delivery costs – Amazon lost a whopping $7.2bn on shipping in 2016, up 43% from a year earlier. The company is candid that delivery costs will ‘continue to increase'. Amazon hasn't yet found a way to control the shipping cost issue that helped kill early 2000s technology wannabes like Webvan, Pets.com and so many others.

At some point – unlikely to be soon – Amazon's US sales growth will also slow. Indeed, this partly explains why the company is now expanding internationally, including into progressively smaller countries like Australia. While Amazon's American success has been helped by favourable trends, it's still very early days in most international markets (for example, Amazon Fresh, its grocery delivery offer, is barely a year old in the UK). To assume the Amazon steamroller will crush all before it ignores the fact retailing is continually evolving.

Nevertheless, it would be a mistake to underestimate Amazon or indeed the broad trends that are driving online shopping. Shareholders in some retailers should certainly be worried, it's true. We'll examine which ones are most at risk in parts two and three of this series.

Until then, three things are certain about Amazon's entry to Australia. One, it will take years for the company to roll out its offer. Two, Amazon will change the retailing landscape but more slowly than you might think. And three, most retailers will adapt, although there might be some pain at first.

Like the mighty river after which it is named, Amazon the company rolls ever on. But just as there are many other rivers, there will be plenty of retailers that end up co-existing with Amazon. Which ones will thrive, and which will fall by the wayside?

Amazon's likely effect on selected ASX-listed specialty retailers

With all the hype around Amazon's entry, you'd be forgiven for thinking Australia's $300bn of retail sales were about to immediately evaporate. But consider this: Amazon's Prime membership – arguably the key driver of the company's retailing success – launched in the UK in 2007. Last year, Amazon's UK sales were just over £7.3bn, which compares with total retail sales of about £360bn.

So it will take time for Amazon to achieve significant Australian sales. To achieve an equivalent percentage of Australian retail sales – around $6bn – might take close to a decade. Developing software, building warehouses and setting up a logistics capability takes time. Even the rumoured launch date of the ‘end of 2018' might be optimistic.

Amazon's rollout will also be staggered. The product range will initially be limited, as will the cities serviced, as will the fast delivery areas within those cities. Australians expecting the same range, delivery and prices offered to US consumers might initially be disappointed. A word of advice, too: if you want something from Amazon's US website – at those famously low American prices – you should probably buy it before Amazon geo-blocks your access from Australia.

Key Points

- Amazon rollout will take time

- JB Hi-Fi, Premier Investments likely to suffer

- Super Retail best of a difficult bunch

What does this mean for the ASX-listed specialty retailers we cover? While Amazon is a very impressive company – see Why is Amazon so formidable? - the lag involved means Australian retailers have time on their side. There's time to improve their service and websites, sign exclusive deals with suppliers, and otherwise shift their strategies to compete more effectively. Many overseas retailers have adapted to Amazon, although it's fair to say that few have thrived.

While Australians still spend less on online shopping per person than many other countries, the reality is that Amazon will have no ‘first mover advantage' here. Australians already have existing options for subscription video, photo storage and music, so Amazon will need to make Prime attractive (the offer varies by market). Also, the collapse of bookshops and electronics chains that allowed Amazon to get big quickly in the US has already occurred here.

Amazon might even find the going tough. That's what happened in Canada, a market with many similarities to Australia. After opening its first Canadian warehouse in 2012, Amazon famously lost market share as online and traditional retailers lifted their game and the market itself grew.

Retailers at risk

None of this is to downplay the threat from Amazon. The company shouldn't be underestimated and has surely learned from its Canadian experience. Australia has a number of specialty retail categories at significant risk of losing sales to Amazon.

Chief among them are books, music, gaming and movies, which are usually the first product categories Amazon rolls out. JB Hi-Fi is the only major ASX-listed retailer with exposure to this category but it's been in decline for years. Over the past five years JB Hi-Fi's ‘software' sales – as it calls music, movies and gaming – have declined from 24% to 13% of the company's total.

That still represents about $500m of JB Hi-Fi's sales, though, so it's significant – particularly as browsing these categories helps attract people to the stores. Assuming Amazon decides to stock physical music or movies (which it may not), these products will almost certainly be cheaper on www.amazon.com.au. JB Hi-Fi should expect the decline in its ‘software' sales to accelerate.

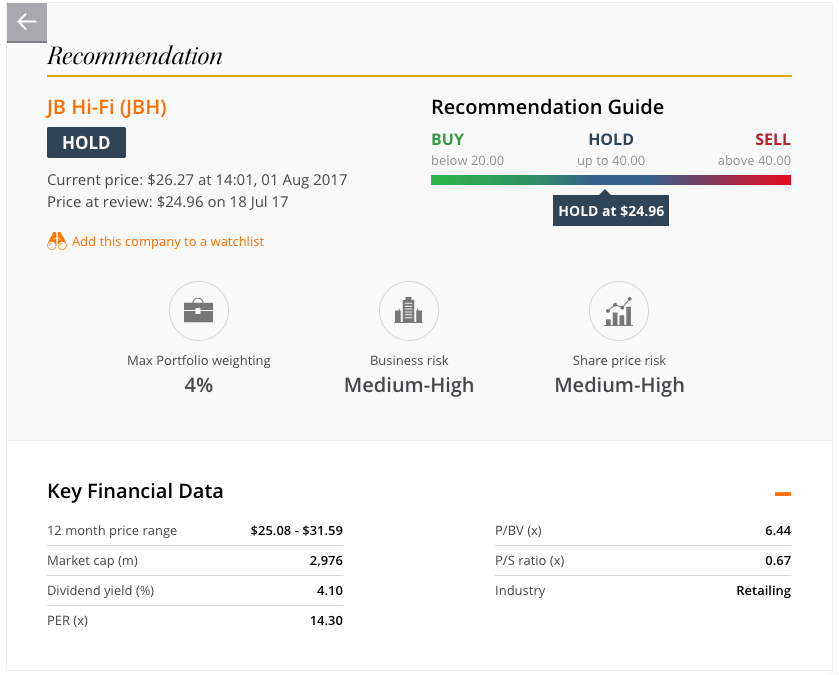

Consumer electronics is another category that Amazon typically rolls out early. JB Hi-Fi is at risk here too because of the easily comparable nature of electronics. Our analysis suggests the company has lost price leadership and seems to be relying on its brand – as well as risky acquisitions – to protect itself. JB Hi-Fi's final result is due on 14 August and we will review our valuation and price guide then, but the long-term outlook is arguably deteriorating. For now, HOLD.

Adapt or perish?

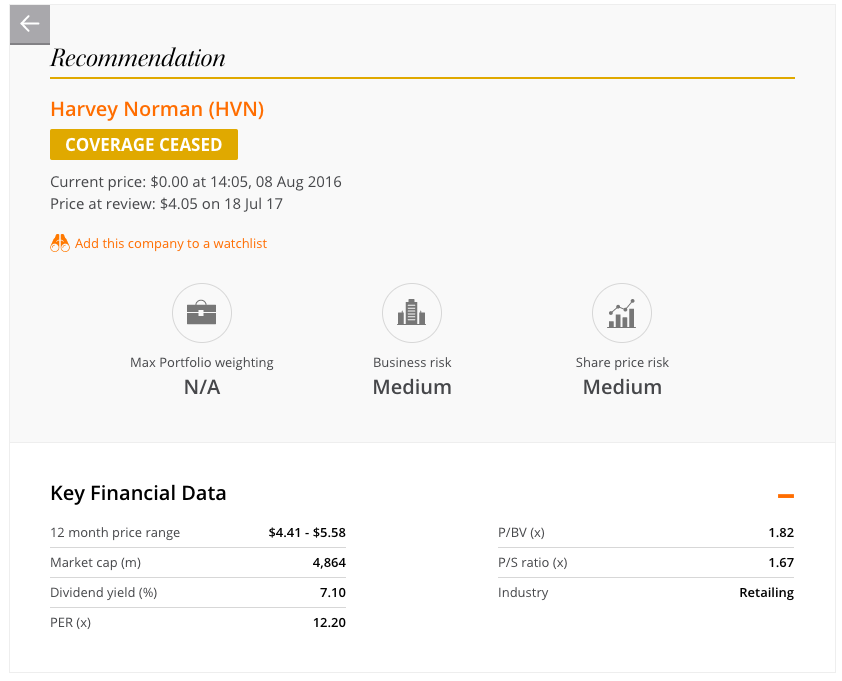

Harvey Norman (no longer covered) is also at risk from Amazon but its franchise business model should allow it to adapt. If the company's consumer electronics franchisees start suffering, it is likely to reallocate retail space towards appliances, furniture, and home fittings like carpet, tiling and bathroomware. These are categories where traditional retailers have usually fended off Amazon.

| Retailer (ASX code) | Market cap. ($m) | Share price movement since 1 Jan 2017 |

Risk from Amazon | Product categories at risk | II reco. | Watch list? |

| JB Hi-Fi (JBH) | 2,928 | –11% | Medium-High | Consumer electronics | Hold (for now) | No |

| Harvey Norman (HVN) | 4,541 | –22% | Low-Medium | Consumer electronics | N/a | No |

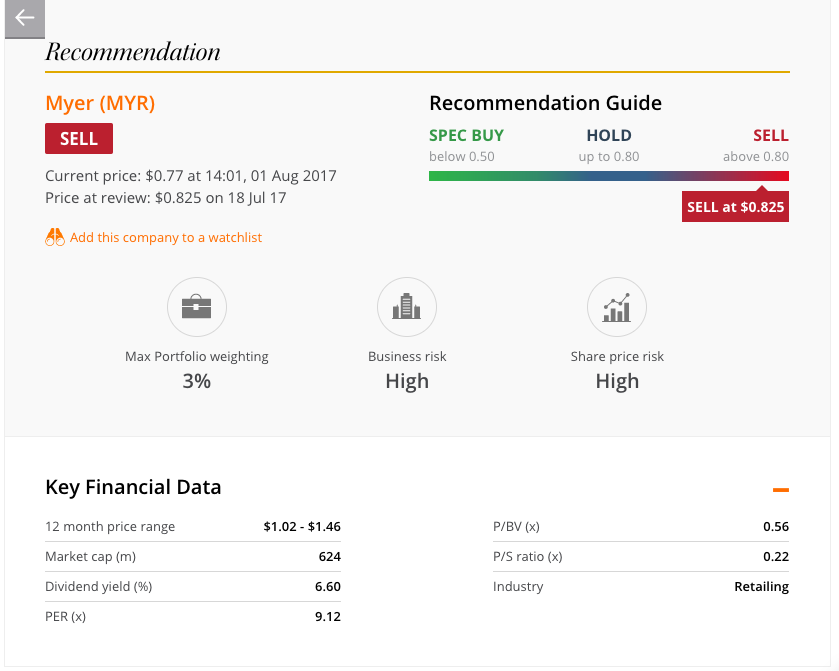

| Myer Holdings (MYR) | 686 | –40% | Medium | Clothing, homewares | Sell | No |

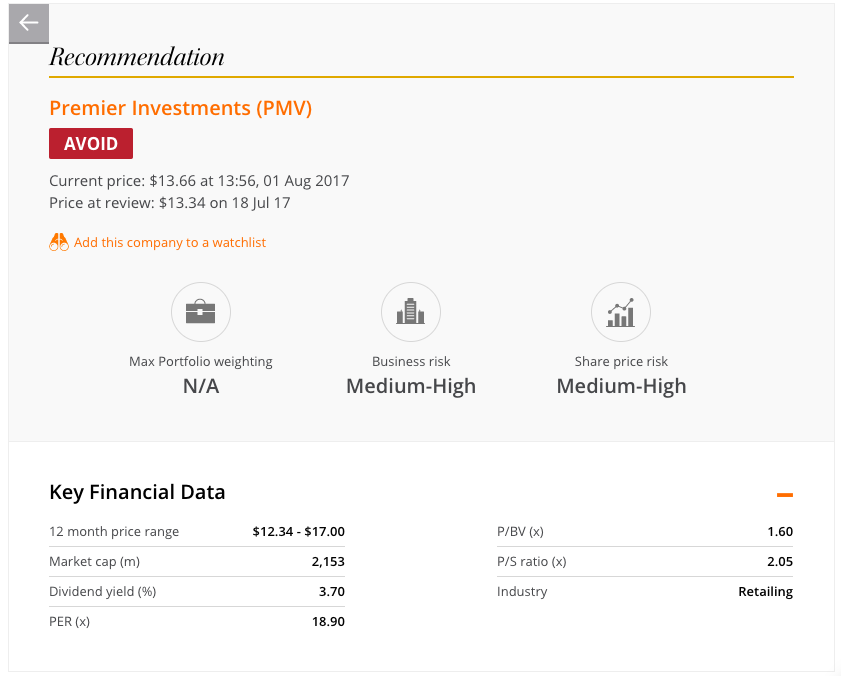

| Premier Invest. (PMV) | 2,108 | –8% | Medium-High | Clothing | Avoid | No |

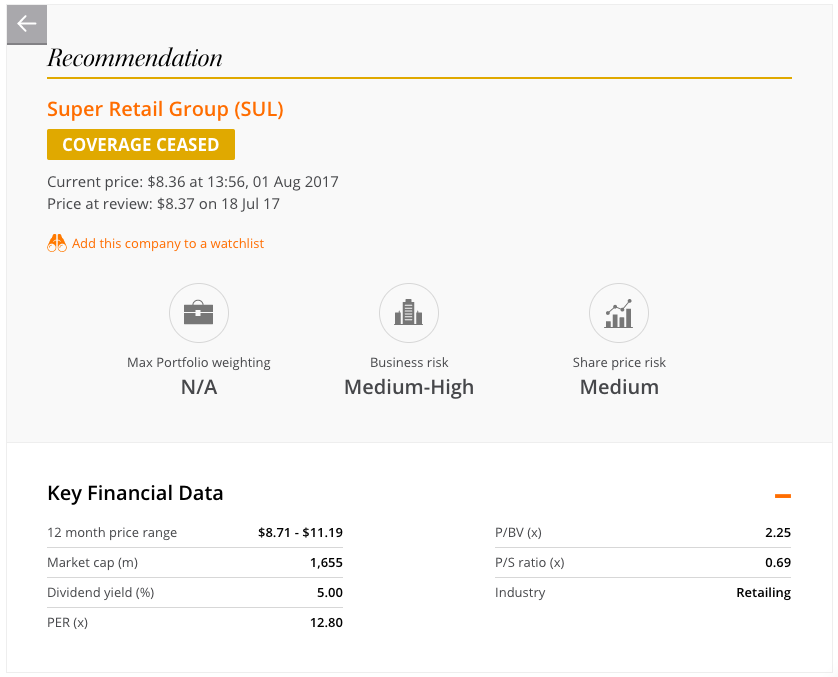

| Super Retail Group (SUL) | 1,683 | –20% | Medium | Clothing, auto, outdoor | N/a | Potentially |

Homewares and toys are often the next categories Amazon rolls out, followed by clothing, footwear and accessories. While clothing is difficult to sell online, Amazon is likely to offer it at launch or within a few years. With heavy exposure to these categories, department store company Myer would seem to be right in the firing line.

It's easy to brand Myer a dead duck in the age of Amazon but that's probably too simplistic. Myer has confronted competition from online and international brands for years. Its market positioning, range diversity and convenience suggest it's probably less specifically threatened by Amazon than some other retailers in the medium term. Of course, that's hardly a compelling investment case.

With its ‘New Myer' strategy having failed to gain sufficient traction, and an uncompetitive online experience, Myer appears to be fighting on multiple fronts. While the stock has fallen 25% since we recommended selling in March – and there is some takeover potential – we see little reason to own the stock, Amazon or not. We're reducing our price guide and sticking with SELL.

Myer's new major shareholder Premier Investments, which owns Smiggle, Peter Alexander, Dotti, Portmans, Jacquie E, Just Jeans and Jay Jays, has already noticed its younger customers migrating online. Same-store sales for its mature brands have been consistently negative. With Smiggle's growth likely to ease, and the stock carrying a premium because of that brand's success, Premier Investments is at significant risk from Amazon in our view. AVOID (or Sell, if you haven't already).

Super interesting?

Super Retail Group, which owns Super Cheap Auto, Rebel Sport, Amart Sports, BCF and Rays is also likely to lose some sales to Amazon (and new entrants like Decathlon) over time. Sportswear, automotive products and outdoor merchandise can be sold relatively easily online, although high-service traditional retailers in these categories should be able to survive. With Super Cheap's share price having fallen 20% this year, it's the only large discretionary retailer that's potentially interesting. Our research continues and we'll resume coverage if a positive recommendation can be justified.

We've focused on the larger discretionary retailers in this review, but smaller retailers are probably at even greater risk from Amazon (and a difficult retailing climate generally). If you'd like us to comment on any smaller retailers you own, feel free to ask in the comments below.

Almost all retailers will feel some negative effects as Amazon's Australian rollout proceeds. But the reality is that most are already facing the threat of sales migrating online. For example, The Iconic – one of Australia's best online-only clothing retailers – has quadrupled sales to almost $200m since 2013 and expects to be profitable in 2017.

The last bastion, perhaps, is online grocery – a category that Amazon has struggled to make work in the US. Next we will cover the ASX-listed grocery retailers: Woolworths, Wesfarmers and Metcash (including their non-grocery chains). Will Amazon's takeover of Whole Foods change the game, or has the company finally met its match?

Amazon vs Woolworths & Wesfarmers

Australia's major grocery retailing companies are under threat from Amazon – but it's not their supermarket businesses that are the problem.

Market concerns about how Aldi would destroy Woolworths are so last year. In June 2016 – in Woolworths: Competition cuts in Part 2 – we argued Woolworths' weak share price had little to do with Aldi's expansion (or, for that matter, Costco's).

The conclusion was that, while the grocery market is getting more competitive, it doesn't spell doom for Woolworths (or Wesfarmers). Since then, Woolworths' share price has recovered as management's turnaround plan has taken effect.

Of course there's always something new to worry about in retailing. This year it's the threat posed by Amazon's Australian entry.

In the first section of this report we showed why the US online behemoth can't be ignored, while in section 2 we highlighted which large discretionary retailers were most at risk. We now conclude with how Amazon might hit the major grocery groups and Metcash.

Key Points

- Woolworths reasonably well placed

- Wesfarmers faces greater threats

- Amazon deal with Metcash possible

Amazon Fresh, the company's full-service grocery retailer, shows that not everything the company touches turns to gold. After launching in the US in 2007, Amazon Fresh has managed to garner just 0.2% national market share (although its share will be higher in the cities where it operates). Amazon Fresh launched a year ago in London, and now covers around 300 postcodes in England's south-east.

But the past 20 years have shown that online grocery retailing is extraordinarily difficult to get right. You need high turnover to guarantee freshness, something that Amazon is struggling with (the company's spoilage rate is reportedly double that of traditional supermarkets). It also costs much more to employ someone to do the picking and delivery than if a customer does both.

Amazon manages this by imposing a delivery surcharge. In the US for example, you need to be a member of Prime as well as pay US$15 a month, making the total cost of Amazon Fresh around US$280 a year. Prime members used to fast and free delivery of Amazon's well-priced general merchandise items are reporting that, while the Amazon Fresh range is extensive, the surcharge tends to offset the slightly cheaper grocery prices offered.

Relentless.com

In typical Amazon style, rather than admit defeat, the company is doubling down and trying new things. In the UK it has partnered with UK supermarket chain Morrisons to improve its fresh offer, while in the US it's trialling ‘click-and-collect' depots in its Seattle hometown.

|

Amazon offers various grocery delivery options in the US. These include: Amazon Fresh

Amazon Pantry

Prime Now

|

Perhaps the most significant initiative, though, is the recently announced takeover of US-based premium grocery chain Whole Foods. Whole Foods gives Amazon fresh food expertise as well as 460 potential distribution outlets around the US. Perhaps the initial strategy is for Amazon customers to visit Whole Foods to choose their fresh produce but click-and-collect their dry groceries and other merchandise.

So what does this mean for Amazon's Australian entry?

Well, as we said, Amazon's rollout will take time. Amazon has reportedly been in contact with Australian dry grocery (but not fresh food) suppliers. It may launch in Australia with an Amazon Pantry-like offer (see 'Amazon grocery delivery options' at right) at the end of 2018 and then implement Amazon Fresh down the track.

The evolution of Amazon Fresh in the US and UK suggests it could take five years to garner even 1% of the $90bn Australian grocery market. Indeed, Amazon's apparent targeting of premium grocery customers suggests a niche rather than mass-market strategy thus far. Whatever the case, there should be time to review how Amazon Fresh is being implemented in Australia before it does much damage.

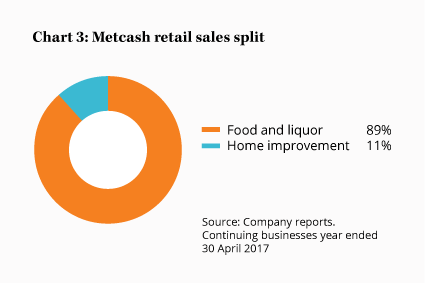

So does this mean Woolworths, Wesfarmers and Metcash have nothing to worry about? Nope, because all three do more than just sell groceries.

Woolworths

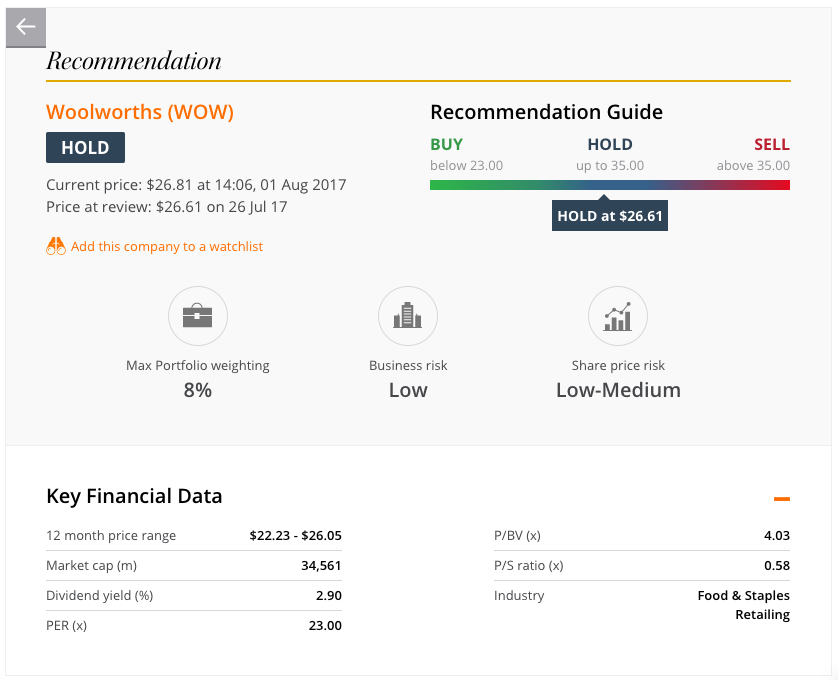

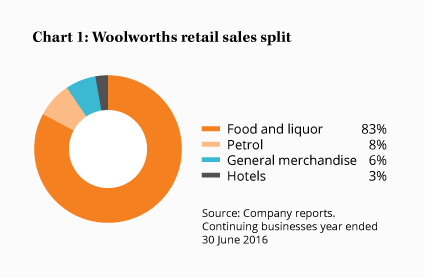

For Woolworths, a year has made all the difference. Last year the stock was out of favour as management cut grocery prices, causing earnings to tumble. But today the company looks the best placed of the three grocery retailers to respond to Amazon.

Woolworths already operates a competitive online grocery business, with sales that jumped 20% in the third quarter of 2017. Unlike the Wesfarmers-owned Coles it offers the same prices as in-store and the service is decent enough. In fact, Woolworths already offers a Prime-like option whereby a $99 annual ‘Delivery Saver' gets you unlimited free delivery for orders of $100 or more. We expect that Woolworths will continue to finesse its offer and is likely to add faster and more flexible delivery times to compete with Amazon if it launches a fresh offer.

Woolworths is also much more flexible with store formats than Coles, with the company now operating 23 smaller format ‘Metro' stores in urban locations. With customers shopping more frequently and preferring convenience, the Metro format seems designed with Amazon in mind (although it's worth noting that Woolworths' past forays into premium stores such as Thomas Dux haven't worked).

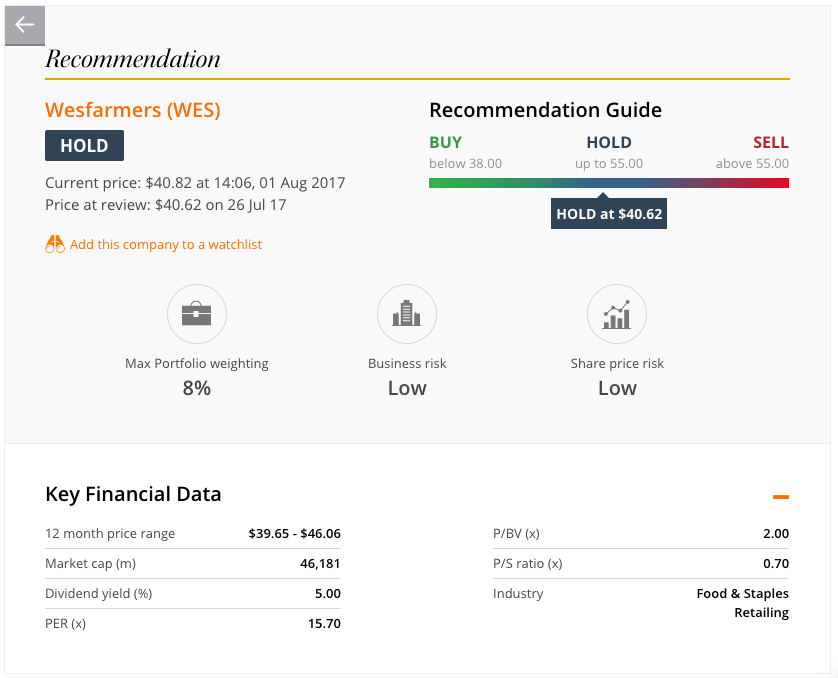

The only other Woolworths business likely to be threatened by Amazon is discount department store Big W, which accounts for 6% of sales (see Chart 1 under general merchandise). But with that retailer already set to make a loss in 2017, it's not as if margins are at risk. Big W is a relatively small component of our Woolworths' valuation, and there's no change to our price guide or recommendation. HOLD.

Wesfarmers

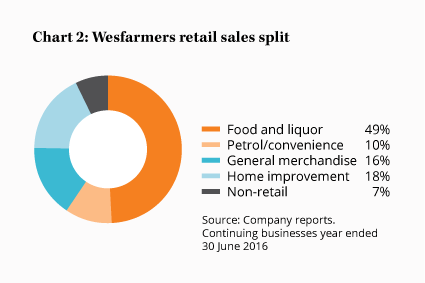

By contrast, Wesfarmers looks a little more exposed. In online grocery, Coles seems to regard its offer as a convenience customers should pay for rather than a defensive initiative. Time will tell whether Amazon's arrival forces a change in Coles' online grocery strategy.

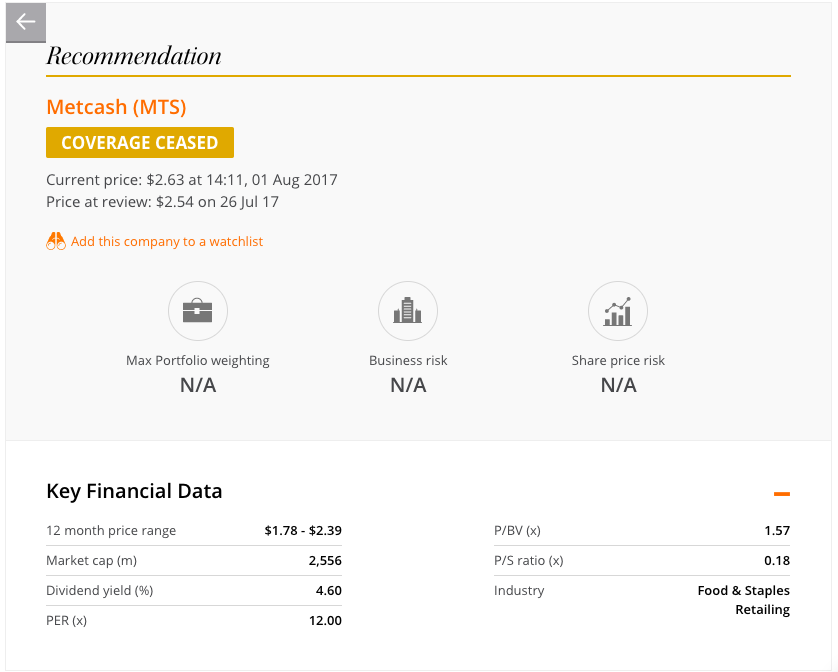

But it's Target, Kmart and Officeworks – accounting for 16% of sales – that look most at risk. Discount department stores are right in Amazon's firing line because budget apparel and homewares are easily sold online. We disagree with Wesfarmers chief executive-elect Rob Scott, who has claimed Kmart isn't particularly threatened by Amazon because it sells low-value items. In fact, this is exactly Amazon's sweet spot (particularly if it offers unlimited deliveries via Prime).

It's also now clearer why Wesfarmers tried – and failed – to sell Officeworks earlier this year. Last year Amazon launched Amazon Business, which is a business-focused version of Marketplace. Now operating in the US, UK and Germany, Amazon Business distributes office supplies much the same as Officeworks. While 17% of Officeworks' sales are already online and it offers same-day shipping, it's potentially at risk.

Home improvement retailer Bunnings, however, should be relatively unaffected, similar to Home Depot and Lowes in the US. While Amazon does sell hardware, it's a category that's often poorly suited to online distribution. That doesn't mean Bunnings can be complacent – its website in particular is behind the times.

Even if we assume that Target, Kmart and Officeworks are all worth zero, though, Wesfarmers' diversification protects it to some extent. In such a scenario, the valuation range in the table from All change at Wesfarmers last month would fall to $26 to $43 a share. However, while we recognise the greater risks of Amazon to Wesfarmers, we're already allowing for a margin of safety in our proposed Buy price. At this stage we're leaving our price guide unchanged and the stock at HOLD.

Metcash

You might be aware of our long-term negative view on Metcash. The business model faces structural challenges, which explains why we recently ceased coverage. Increasing competition could hurt Woolworths and Wesfarmers, but it could kill Metcash.

On the other hand, Amazon's arrival could have a silver lining. It's possible Amazon could strike a deal with Metcash to source fresh and frozen food, just as it has done with Morrisons in the UK. Morrisons has taken the view that the deal will expand its market share rather than cannibalise its own stores.

There's some merit in that argument for Metcash too. Not only are the Amazon Fresh and IGA customer demographics somewhat different, IGA is strong in states and regions that are less likely to be targeted by Amazon. The additional volume Metcash would gain might help it reduce prices for all customers, including Amazon and IGA independents. That's how Metcash might sell the deal to its IGA customers, anyway.

A deal like this would clearly be negative for Woolworths and Wesfarmers. Amazon would obtain a fresh food offer much faster than otherwise, something we think it might otherwise struggle with. Of course, speculation about a deal with Amazon is insufficient reason to re-commence coverage.

So where does this analysis leave the major grocery retailers?

Our recommendations and price guides on Woolworths and Wesfarmers are unchanged. But, in undertaking our research, we're slightly more negative on Wesfarmers than before. With greater exposure to discretionary retail than Woolworths, Wesfarmers has more to worry about. While Wesfarmers' 10% share price decline since late March is largely due to a profit downgrade at Coles, Amazon is weighing on the stock too.

The news flow for retailers could remain negative for some time, especially as Amazon's Australian arrival is likely to be accompanied by fanfare and exciting ideas. Perhaps the US behemoth might trial advanced robotics in its Australia warehouses, or it might even roll out physical stores to reinforce its brand.

Of course, as we said the large listed retailers have a little time to adapt their offers. None of them are standing still.

Our views will continue to evolve and we'll update you accordingly. But our core message on Amazon's onslaught is: don't panic. In fact, buying opportunities might not be far away.