All new Editor's Picks

Inflation and global growth have been the dominant themes this week, with China’s unexpectedly poor manufacturing figures sending a shiver through global markets.

Alan Kohler argues that central banks seem to be losing the fight against deflation – globally it is 1.5 per cent, in Europe 0.7 per cent. Deflation is not good. Japan has suffered from it for years and is furiously shovelling money into their economy to try to stop it. Commodity prices have been falling (bad news for our big miners writes Stephen Bartholomeusz) but oil prices have held up. However, with fracking continuing apace in the US, and Libyan oil production returning, we could now see a big drop in the price of crude and further downward pressure. Alan warns we could, "find out what deflation in the modern world means in practice, instead of just in theory.”

Here in Australia we’re certainly accustomed to escalating prices, just ask anyone trying to get into the housing market. But a surprise figure of 0.9 per cent for the quarter suggests that full year inflation might go above the RBA’s upper limit, something that would ordinarily prompt a rise in interest rates. Economics editor and former RBA economist, Callam Pickering thinks that Glenn Stevens shouldn’t react to the numbers too quickly. “There is a reason why interest rates currently sit at historically low levels,” he writes. “It is becoming increasingly obvious that there is sufficient weakness across the economy to justify those interest rates.” He has three compelling reasons why the RBA should sit on its hands.

Robert Gottliebsen reckons that the big drivers of house price inflation – Chinese and local investors in the Sydney and Melbourne apartment markets – might be in for a shock. Talking to his old mate and Meriton founder Harry Triguboff, Robert discovers that the days of tight supply could be over. Restrictive construction laws could be lifted and a wave of Chinese developers are eyeing the market. “The dam walls are cracking,” Triguboff says. Watch this space.

The idea of “invading Chinese hordes” gets many Business Spectator readers hot under the collar but sometimes people forget how important they are to our export future. China Spectator’s Peter Cai tells the delightful story of Bobbie the Bear – a lavender filled doll that acts like a hot water bottle when put in the microwave. The Tasmanian manufacturers were swamped when one of China’s hottest film stars gushed about the product to her 3.8 million followers on social media. “Our phone system has gone into meltdown,” cried the owners. Tourism Australia is actively courting Chinese on social media – if you have something to export, you should too.

Where one government agency giveth, another taketh away. Everyone is aware of the potential of the dairy industry – clearly none more so than Canada’s Saputo - but Stephen Bartholomeusz points out that the regulatory system seems to currently favour foreign bidders over local ones. It’s not much good promoting national champions if the government is working against you. Something needs to be done if we are to compete in a globalised world.

Back to Chinese growth and the big question of how much petrol is in the tank. While Chinese PMI was bad, official growth figures were above expectations at 7.7 per cent. Not bad China, not bad. But China is trying to slow its economy down to a more sustainable level. The big problem with that writes Peter Cai is that nearly half of China’s firms would be unprofitable if growth drops below 7 per cent. That's not good news for Australian miners who rely on China's razor-margined steel mills for custom, let alone for the 7 million Chinese graduates entering the job market every year.

Other important reads

Is Bill Shorten becoming the Brendan Nelson of the Labor Party? His insipid performance so far would suggest so, says Michael Gawenda.

Don’t mention the welfare: Germany preaches austerity to its neighbours but opts for a big social spending program back home, by Oliver Marc Hartwich.

Most Read

Sydney’s Property Dam is about to burst by Robert Gottliebsen.

Most Commented

Roosters are pecking at Abbott's Australia, by Rob Burgess.

What you probably didn't read but should have

The Arnotts' new bread and butter, by Alan Kohler. This is what business is all about. Alan's heartwarming tale about love, loss and family charts the demise and (hopeful) re-emergence of one of the most famous names in baking.

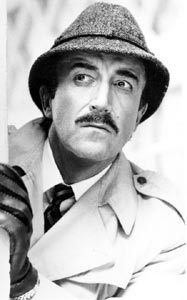

Image of the week

Is Ben Bernanke the Inspector Clouseau of the global financial crisis? Bye, Bye Bernanke, by Steve Keen