A rare earths revival

|

Summary: The Chinese government is behind a revival in the rare earths mining sector, with its clampdown on a number of mining operations creating a tailwind for Australian companies involved in producing the metals derived from rare earths. |

|

Key take-out: But the positive winds blowing through the sector could quickly change direction, meaning investors keen enough to speculate should make sure they get their rare earths demand timing correct. |

Flickers of life have been detected in the largely forgotten rare earths sector of the mining industry, a graveyard for investors who held on for too long after boom conditions in 2011 came to an abrupt end.

Whether history is starting to repeat is a question for speculators to consider, because the conditions which triggered the boom appear to be similar to what's happening in the market today for the group of 17 elements that qualify for the term rare earth.

Chinese government policies are at the heart of a 40 per cent rise this year in the price of materials such as neodymium and praseodymium, which are essential in high-strength magnets of the sort used in most vehicles, emerging “green energy” technologies, and weapons such as guidance systems in rockets.

Ten years ago it was Chinese export controls that started a rare earths price explosion, because at that time China accounted for 95 per cent of global production. It placed strict limits on how much could leave the country, a policy which pushed prices sharply higher.

The US, in particular, was deeply concerned that the export controls would affect its military programs, so it started to actively encourage new sources of supply. That policy was negated when China increased exports, a change which crushed prices.

Today's pressure on the market is being caused by China enforcing an environmental clean-up of an industry dominated by small producers, few of which appear to care much about the mess they cause in the mining and processing of rare earths.

The net result of the latest events in China can be seen in the rising prices for rare earths and an equally interesting rise in the price of the handful of non-Chinese players in the rare earths business. These include Australia's leader, Lynas Corporation, and other potential producers such as Alkane Resources, Greenland Minerals, Arafura Resources and Northern Minerals.

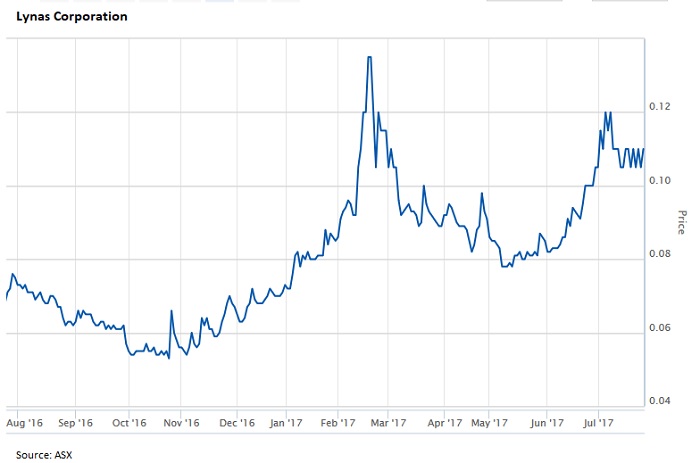

Lynas, for example, has more than doubled from a low of 5 cents reached last October to recent sales at 11 cents.

But, to put that latest price in perspective, you need to look back at the height of the export-controls boom of mid 2011 when Lynas traded up to $2.55. This raises the interesting question as to whether Lynas has really doubled, or has fallen by 95.7 per cent.

Alkane, which is making most of its money from gold production, has been the other rare earths mover. Interest has returned to its potentially world-class Dubbo Zirconia Project in western NSW, which has been designed to produce a cocktail of elements including a basket of rare earths.

Over the past six weeks Alkane shares have risen by 55 per cent from 21.5 cents to 33.5 cents, a price which also needs to be tested against the stock's 2011 high of $2.63.

Whether the current industry settings are the precursor to a second rare earths boom is an interesting debating topic, with most investors wisely taking a sideline position as the picture develops.

Caution, however, cannot totally ignore three factors underpinning the signs of a rare earths revival. They are:

- Demand from green technologies, with rare earths enjoying rising demand in the same way that prices for the family of battery minerals such as lithium, cobalt and graphite are being pushed higher.

- China's fiddling with market forces, with export controls being replaced by merger and clean-up demands with a similar effect on supply.

- Stirrings in the US, where this year's 40 per cent rare earths price rise has returned that country's sole rare earths mine, Mountain Pass in California, back onto the political stage.

The US development has two elements. One is a proposal from the technology sector that Mountain Pass, which is currently trapped inside a failed company called Molycorp, be nationalised to ensure future supply. The other is a legal case that's expected to come to a head, when a judge will rule on whether Molycorp's residual assets can be sold.

The latest news from China is that the government crackdown is producing the desired result of forcing small rare earths companies out of business, or into a merger.

One company has been hit with a $US5 billion clean-up bill that is guaranteed to see it close or be acquired by a government-approved owner.

In Australia, the reviving interest in rare earths is behind a number of developments, including the share-price recovery by Lynas and Alkane, and a successful $2 million capital raising this week by Northern Minerals. It is developing the Browns Range project on the border of WA and the Northern Territory.

Watching the pieces fall into place in the next phase of the evolution of the rare earths industry will be interesting.

But if history is pointing to a return of boom conditions it could also be pointing to a repeat of a future bust, because there are four other factors for investors to consider:

- Rare earths are not earths. They are a collection of elements, mainly metals.

- They're not that rare. It's just that demand has been so low until recently that supply has not been encouraged.

- Because the market for rare earths is relatively small, there will not be room for many new suppliers outside of China, and

- Ongoing government interference in the business seems highly likely because of the strategic importance of some of the rare earths in military applications.