A hot run for manganese

Summary: The price for manganese ore has gone through the roof, and those companies linked to the metal have delivered strong market gains.

Key take-out: The question for manganese investors is, can this last? History shows manganese has soared in the past, only to come off the boil following sharp increases in supply.

A decade in the doldrums is over for manganese, one of the mining world's most erratic minerals.

But, before investors get too excited about its return, they should look back at how a price boom in the steel-hardening material can end as quickly as it started.

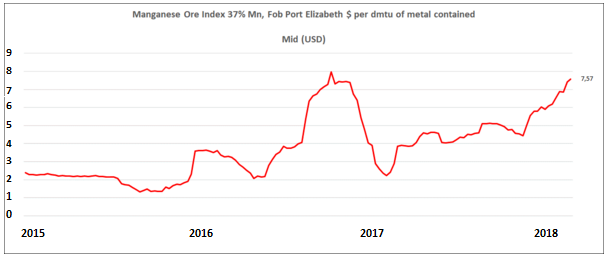

Multiple factors have put manganese back in the headlines, topped by a rapid increase in the price over the past 12-months, from around $US2.20 per dry metric tonne unit (the complex way in which it is traded) to a current price of more than $US7.50/dmtu.

That 240 per cent rise has flushed out a variety of manganese investment opportunities, with the most impressive being the planned return to the Australian stock exchange of Jupiter Mines, led by a former chief executive of BHP (when it was BHP Billiton), Brian Gilbertson.

Jupiter has a 49.9 per cent stake in the rich Tshipi manganese mine located in the Northern Cape province of South Africa, and is in the process of selling a stake in the business to Australian investors, followed by a relisting on the ASX after a four-year absence.

Gilbertson, and fellow shareholders in Jupiter, delisted the stock in 2014 to finalise construction of Tshipi, which is now exporting high-grade manganese at a rate of around 3 million tonnes a year, rising to a design capacity of 3.6m/t a year.

A syndicate of brokers and bankers, including Hartleys, Foster Stockbroking and Aitken Murray Capital Partners were appointed late last year to handle the ASX relisting. This could see between 15 per cent-and-20 per cent of Jupiter sold by its existing major shareholders at a price reported to be around $200 million, theoretically valuing Jupiter on relisting at $1 billion.

The return of Jupiter (and Gilbertson) is not the most remarkable feature of manganese making a comeback, thanks primarily to China's crackdown on polluting industries. This event has also played a role in the continued high price for premium quality iron ore.

A more impressive manganese measure is through the share price of OM Holdings, a Singapore-based but ASX-listed miner which operates the Bootu Creek mine in the Northern Territory, and which also holds a minority stake in Jupiter's Tshipi mine.

Over the past 12-months, as the manganese price has recovered, OM's share price has risen by more than 900 per cent, from 11c at this time last year to recent sales at $1.13, down on a multi-year high of $1.50 reached late last month.

Other indications of manganese becoming the mineral flavour of the month include:

- Growing interest in manganese as a component of the batteries used in electric cars, potentially taking market share from cobalt, which is approaching a record price of $US100,000 a tonne and which will encourage substitution – if that's possible.

- Sharp share price rises by a number of small manganese explorers. Montezuma Mining is up 11.5c (57 per cent) since mid-January to 31.5c after announcing plans to accelerate work on its Butcherbird prospect in WA, and Bryah Resources has added 2c to 14c after reporting the recovery of high-grade manganese in rock-chip samples from its Bryah Basin exploration project, also in Western Australia, and

- Atlas Iron, a financially stretched iron ore miner, reporting on Monday that it had struck a deal to transport manganese ore for a private mining company, Horseshoe Manganese, to its iron ore loading facility at Port Hedland, a development described as part of a diversification plan.

Reasons for caution

Encouraging as all of those developments are for manganese miners, and investors in manganese exposed stocks (which including South 32 with its part-owned mines in Australia and South Africa), there is good reason to take care with manganese.

Back in the late 1990s, as China's demand for minerals and metals started to accelerate, a small Australian manganese miner, Consolidated Minerals, became an overnight sensation on the ASX as it redeveloped the Woodie Woodie mine in WA.

Rescued from insolvency caused by a manganese price collapse several years earlier, ConsMin enjoyed a period of spectacular growth – until the manganese price collapsed (again) thanks to a sharp increase in supply from other previously mothballed mines.

In time, control of ConsMin passed to a Ukrainian billionaire, Gennadiy Bogolyubov, but even he could not make money out of Woodie Woodie, which was closed – until late last year when a Chinese company started to restore production.

The latest market for manganese, which is sold in a variety of forms, can best be seen in a graph produced by Jupiter Mines and based on material exported from South Africa. It shows the price for ore assaying 37 per cent manganese (an industry standard) and how it has risen from around $US2.20/dmtu to a price of $US7.57/dmtu on Monday.

It is theoretically possible for the manganese price to remain at that elevated level, but it is equally possible for the mineral to slide back to around $US2.20/dmtu mark where it was just 12-months ago.

Perhaps more importantly for investors with an appetite for a taste of manganese, there is a loud message in the last price spike which saw the mineral reach $US8/dmtu in late 2016 before sliding to $US2.20/dmtu six months later.

Grade is king

If there is a key to manganese it's the same as it is for all commonly available minerals, and that's the quality of the orebody, a situation summed up in the oldest of mining sayings: “grade is king”.

Gilbertson, with a career of running big and small mining companies, understands the importance of ore quality, which is why he has committed Jupiter and its partners to Tshipi, a mine with extensive reserves at a world-class 44 per cent manganese.

Tshipi, and other mines in the Kalahari Manganese Field of the Northern Cape in South Africa, have the grade to ride out what have been routine manganese price slides. Low-grade mines rarely survive a prolonged price dip.