A consumer-led US recovery is just around the corner

Household spending in the United States continues to rise at a moderate pace but we have yet to see the type of growth that might be expected, given the strong employment figures posted this year. There are reasons for that -- soft wage growth and a low US dollar being just two -- which are set to be more favourable in the year ahead.

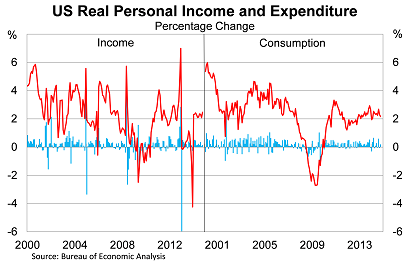

In the United States, real personal consumption rose by 0.2 per cent in October, missing market expectations, to be 2.2 per cent higher over the year. This followed a flat result during September.

Household spending in October is 0.3 per cent higher than the September quarter, suggesting that the consumption is well placed to make a meaningful contribution to December quarter growth.

x

The disaggregated data presents a fairly mixed view. Spending on durables continues to ease, down 0.1 per cent in October to be 6.8 per cent higher over the year. The consumption of non-durable goods recovered in October after a poor September, while growth in services moderated slightly.

Spending continues to be somewhat-at-odds with the steady improvement in the labour market. Usually the relationship between jobs and spending is fairly straightforward: high employment equals higher incomes (whether in aggregate or via higher wages) and that results in higher household spending.

Yet that has yet to eventuate, at least not materially. What's going on?

There are a number of reasons why spending hasn't taken off, but we shouldn't discount the possibility that a consumer-led recovery isn't just around the corner.

A key problem is that real income growth remains subdued, rising by just 0.1 per cent in October to be 2.5 per cent higher over the year. I'd also note that this measure of income is quite broad, including a range of factors that aren't particularly relevant to lower or middle-income earners.

Real average hourly wages, for example, have increased by just 0.3 per cent over the year to October. In the short term, spending can defy income growth; we can use our credit cards to smooth our spending patterns. But eventually our consumption is tied to our incomes and on that basis, it's no surprise that spending remains well contained.

Driving this trend is the fact that job growth has been concentrated in lower paid sectors, such as fast food, administration and retailing. The economy is absorbing much of the existing spare capacity but the result has been a downwards shift in aggregate wages, which continues to weigh on spending.

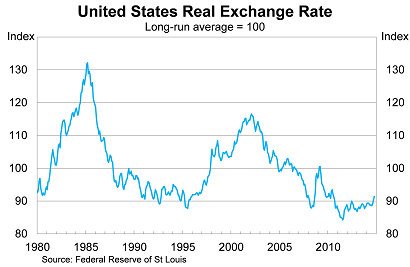

Households also haven't been helped by the weak US dollar. The dollar has been beneficial for US manufacturing -- in part helping to support employment growth -- but it has also reduced the purchasing power of US households. That's slowly beginning to change and should underpin stronger consumption growth in the year ahead.

Softer household spending cannot be entirely explained by these factors. A comprehensive analysis would also require consideration of factors such as US Congress' decision not to extend emergency unemployment benefits and the demographic shifts that have weighed so heavily on labour market participation. But it should give you a reasonable understanding of why the US consumer remains a little cautious.

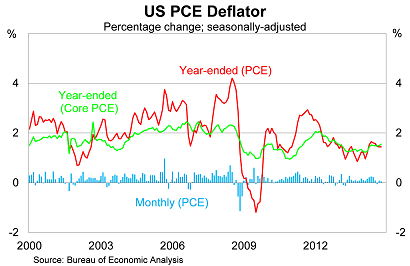

The monthly consumer report also contains important information on inflation trends. The personal consumption expenditure deflator rose by 0.1 per cent in October, to be 1.4 per cent higher over the year.

Headline inflation is being weighed down by softer energy prices, due to the sharp decline in oil prices, and that should support household spending in the months ahead.

The core PCE deflator -- the Federal Reserve's preferred measure of inflation -- increase by 0.2 per cent in the month, to be 1.6 per cent higher over the year. The core PCE deflator is now rising at its fastest annual pace is almost two years.

Nevertheless, the core PCE deflator remains well below the Fed's 2 per cent annual target, which indicates that there remains some spare capacity across their labour market. The speed with which this is absorbed will dictate whether wages begin to breakout. If that happens I expect inflation to push towards the Fed's target quite quickly.

The household sector remains a key part of the US recovery. As the dollar trends higher, the onus will be on the US consumer to open their wallets and start spending. The jobs recovery so far hasn't really supported that, but combined with a stronger US dollar and an eventual wage breakout, that should begin to change next year.