A beginner's guide to buying bonds

Summary: Investors have a range of avenues to buy bonds in Australia, including on the ASX and over the counter.

Key take-out: You will need arrangements in place with a broker to buy, sell and hold bonds though a custodial account.

In a recent article I spoke of five reasons to own corporate bonds. Today I want to talk about the main ways that retail investors can access bonds.

There are two markets for direct bond ownership in Australia. The main market is the over-the-counter (OTC) market conducted by Austraclear. The other is the Australian Securities Exchange listed market, which is much smaller and has a limited choice and liquidity.

Accessing the markets

Whether you buy bonds on the OTC or ASX listed markets, you will need arrangements in place to buy, sell and hold those bonds in safe custody.

Most brokers will charge a fee to set-up a custodial account, where the beneficial ownership of the bonds remains with you, the investor.

Other indirect ways to invest in bonds include:

- Managed funds that are dedicated to bonds;

- Funds with an allocation to bonds; and

-

Exchange traded bond funds (ETFs) on the ASX.

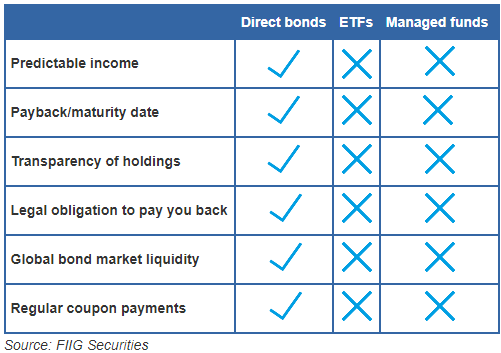

However, many of the advantages of direct ownership are lost through these avenues. For example, when to buy and sell, which bonds to invest in, and whether to trade your bond portfolio or adopt a ‘hold to maturity' strategy. The table below shows some of the other advantages and disadvantages of direct bond investment versus managed funds and ETFs.

The Australian OTC bond market operates like it does in most other countries around the world. Generally, direct investors use the services of a bond dealer/broker.

First, you need to determine the bonds in which you would like to invest.

Dealer/brokers can provide you with lists of bonds, prices, interest rates and research for you to decide which bonds to purchase to suit your requirements. Generally, bond dealer/brokers will buy the bonds you choose at one price and sell the bonds to you at a slightly higher price. This is called the ‘margin' and is how broker/dealers earn their revenue.

What can you invest in?

1. Over the counter market

The value of the global bond market is $US92 trillion and there are many thousands of bonds available to investors. The Australian bond market is relatively small but growing and is estimated to be worth $1.9 trillion, with over 300 companies and other entities issuing bonds into the market. Direct over the counter investors have the opportunity to buy Australian dollar and foreign currency bonds.

Late last year we found that 46 of the ASX top 50 companies issue corporate bonds in Australian dollars and in up to 18 other currencies. It's a very large market!

Many bonds trade in minimum face value parcels of $500,000 in the Australian OTC market. However, some bond dealer/brokers provide services where bonds can be directly purchased by investors in smaller parcels sizes of $10,000 per bond.

This market is harder for individual investors to access and generally requires higher minimum investment amounts, for example, $250,000.

2. Australian Securities Exchange

ASX listed corporate bonds and hybrid securities don't have any minimum purchase amount, but the range of available bonds and liquidity is small. There are only five corporate bonds listed on the ASX, and roughly 50 exchanged traded bond units (XTBs).

An XTB allows investors to buy units in a trust representing ASX50 companies' wholesale bonds.

The primary benefit of the XTB units is their very low minimum investment, but the bonds have low yields.

Government and semi-government bonds can be also be bought via the ASX for as little as $1000. A selection of Commonwealth government bonds are available via the ASX in the form of CHESS Depository Interests (CDI). State and territory bonds can sometimes be bought direct from the issuers or through a bond dealer/broker.

What's next ?

If you want to invest direct, you need to consider where you think interest rates are headed for the next few years as this will help you determine your allocation to the three different types of bonds: fixed rate, floating and inflation linked. You also need to consider the return and therefore the risk you are prepared to accept, and any future dates when you may need funds (and link to maturity dates of the bonds).

It's important to do your research. One of the attractions of direct investment is that it is a bespoke service, where you invest in the bonds that you choose to meet your needs; very much in tune with the SMSF investor psyche and requirements.

Glossary of Terms

Austraclear

An electronic system managed by the ASX for the settlement and registry of money market and fixed income securities.

Coupon

Name on an interest payment for bonds.

Fixed rate bond

A fixed rate bond is a security that pays a fixed pre–determined distribution or coupon. The coupon of a fixed rate bond will be set at the time of issue and not change during the life of the bond. The Commonwealth Government, state governments, banks and corporates all issue fixed rate bonds in Australia.

Floating-rate notes

A floating rate note (FRN) or bond is a security that pays a coupon linked to a variable benchmark. In Australia most FRNs pay a coupon set as a margin above the bank bill swap rate (BBSW) which is the market benchmark three-month interbank rate. The actual coupon for an interest period will be determined at the start of that period by applying the margin to the three-month BBSW rate on the first day of the coupon period. The three-month BBSW rate will rise and fall over time based on prevailing interest rates. The margin is fixed and will be set at the time of issue.

Government and semi-government bonds

Australian Commonwealth government bonds trade in amounts of $1000, and interest payments and the re-payment of face value at maturity are Commonwealth Government guaranteed. Also known as Commonwealth Government Securities (CGS), government nominal bonds have maturities currently ranging from one year to 30 years, which may be bought and sold on the secondary market.

Hybrid securities

A broad classification for a group of securities, used by a range of corporations to raise money, that combine both debt and equity characteristics. These are usually higher risk investments due to their subordination in the capital structure. In Australia, the major banks are large issuers of these types of securities.

Index linked bonds

Index linked bonds are securities whose return includes a component that is determined by the future level of a predetermined index, for example; CPI or inflation. There are two main types of inflation linked bonds issued in Australia – capital indexed bonds (CIB) and indexed annuity bonds (IAB).

Maturity

This is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Minimum investment

Minimum amount required to invest in an offering or security.