8 biggest money mistakes to avoid when you're young

Give yourself a head start in life by avoiding these common financial mistakes and developing good habits.

Your 20s and 30s are filled with milestones, such as learning to drive, finding a partner and building the foundations of a career. The decisions you make now can be the difference between financial success or living paycheque to paycheque down the road. Here are eight common financial pitfalls to avoid when you're young.

1. Not putting aside money for emergencies. If you don't have ready access to cash, you're more likely to be forced to take on costly debt if you run into trouble, such as the loss of your job. A good rule of thumb is to have at least 6 months' worth of living expenses in a high-interest online savings account.

2. Buying an expensive car. This is probably the biggest mistake people in their early 20s make. Cars depreciate in value and are generally more costly to run than using public transport. Putting, say, $10,000 into an index fund when you're 20 instead of buying a car could add hundreds of thousands of dollars to your net worth by the time you retire, even at modest returns. Hold out from buying a car for as long as possible.

3. Accumulating credit card debt. Credit cards are the most expensive form of debt you will probably encounter. Missed payment fees and high interest can start you down a cycle of mounting debt that's difficult to escape. People under 35 with too much credit card debt account for 49% of personal bankruptcies. To learn some simple steps to pay off your credit card, check out ASIC's MoneySmart website.

4. Not setting financial goals. As the saying goes, ‘That which is measured, improves'. It's important to set yourself a budget, monitor your investments and lay out some achievable goals of where you want to be in 10 years. Identifying goals and measuring your progress makes it easier to focus on what steps are needed to get you where you want to be.

5. Not investing for your retirement. It seems like a lifetime away, but what you save and invest now will have a disproportionately large affect on your standard of living in retirement. If you start saving and investing early, you let compound interest do the heavy lifting throughout your life. To see what a difference starting early can make, see So your kids want to be millionaires? Show them how with one chart.

6. Not talking about finances before getting married. A 2021 study of couples found that arguments about finances are by far the top predictor of divorce. Money can be a touchy subject, but if you want a happy marriage it's important that you and your partner are on the same page. Talk about your monetary situation, set financial goals together, make a savings plan and discuss what you consider irresponsible spending before you tie the knot. The same study found 94% of couples who said they had a "great" marriage regularly talked about their money together.

7. Spending too much on your wedding. Weddings can be ludicrously expensive events. But a 2014 study of 3,000 people found that men who spent $2,000 to $4,000 on engagement rings were 30% more likely to end up divorced than those who spent $500 to $2,000, after controlling for demographic factors. And women whose weddings cost $20,000 or more were 3.5 times more likely to end up divorced than those who spent $5,000 to $10,000. Starting married life with a huge pile of debt is likely to add unnecessary stress to your relationship.

8. Buying a bigger house than you need. Trying to keep up with the Jones's is a sure-fire way to unhappiness. Don't stretch your finances too thinly to get the most expensive house possible. A larger house than you need means you will incur unnecessarily high maintenance costs, and it can also add stress if you lose your job and can't make repayments. Property ownership can be a sensible way to invest for your future but it can also backfire completely if property prices decline substantially, as many in the US discovered in 2007-09. It's important to be mindful of your opportunity costs, such as a more diverse portfolio that includes stocks and other growth assets.

For those of you in your 50s and 60s, what advice would you give to your younger self?

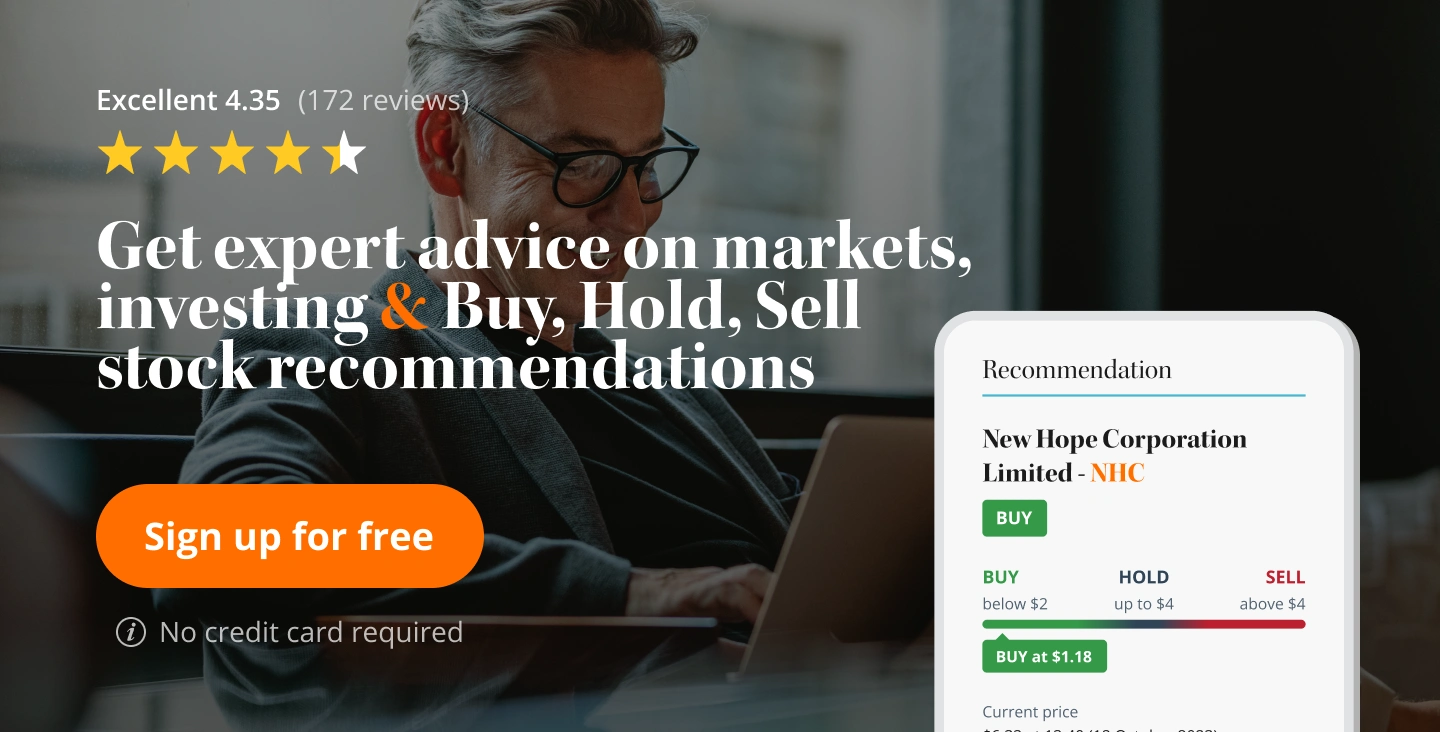

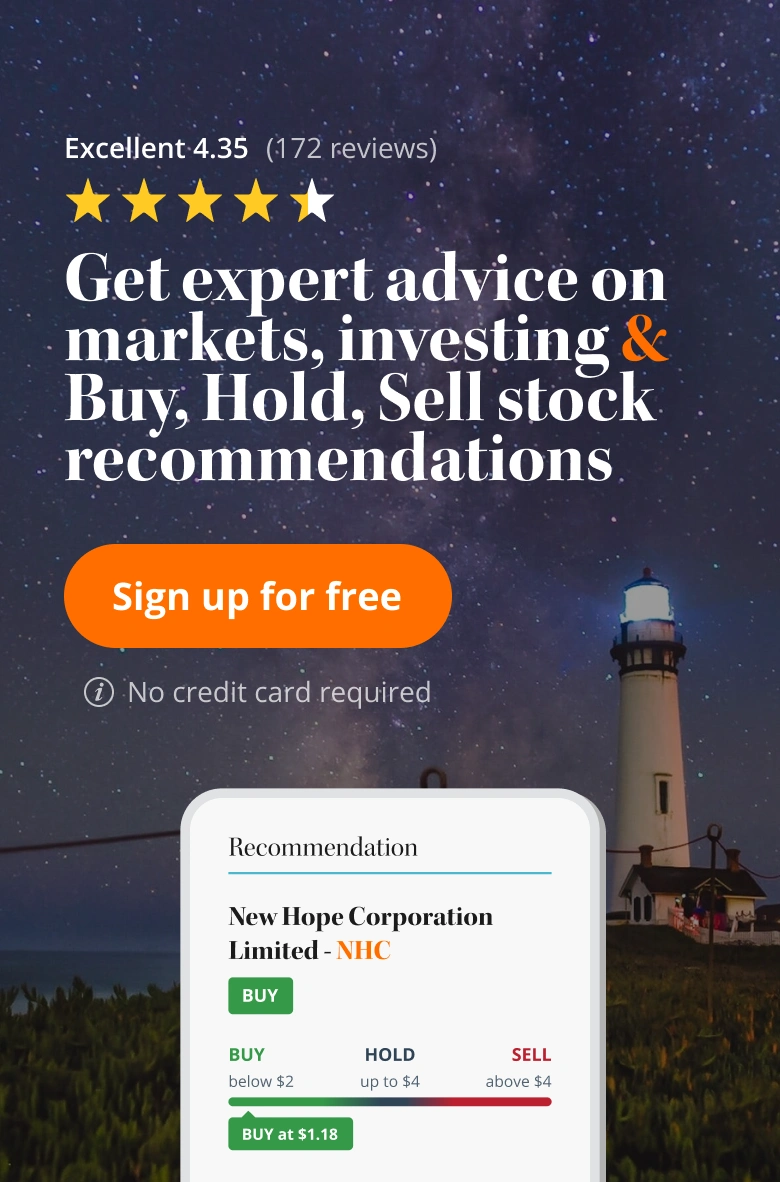

Want to hear more from the Intelligent Investor team? Take a free 15 day trial and unlock all of their buy, hold and sell stock recommendations.