3P Learning: Result 2018

Recommendation

Legendary short seller Marc Cohodes has claimed that Mimedx, a North American skin graft manufacturer, is a criminal enterprise. So confident is he of the company's wrongdoing, in fact, that he's pledged to bake a cake for Mimedx's former CEO when, not if, he's sentenced to prison.

We couldn't comment. But what stands out about Cohodes's approach – apart from his relentless, confrontational style – is how he utilises optionality: ‘I like investments, long and short, where I can win a number of ways'.

It matters little to Cohodes whether Mimedx is exposed for faking revenue, channel stuffing or Medicare fraud. He needs just one of them to topple company and enrich himself.

Key Points

-

Profit boosted by ARPU, but bereft of licence growth

-

Product improvements flowing through

-

Less optionality after Learnosity sale. HOLD

So it is with 3P Learning, Australia's preeminent educational software business, that's also awash with optionality. Thankfully, it's of a more positive variety, so we don't expect it to attract Cohodes's attention, but it has caught ours.

Much has changed in the 18 months since we first recommended 3P Learning, though, with management discarding non-core investments and closing underperforming business lines, as well as creating a new one in Readiwriter, its new literacy product.

With the full-year result providing an important checkpoint it begs the question: does the investment case still stand or has it deteriorated?

So long Learnosity

One of the options we originally identified was the 40% stake in private education software widget maker, Learnosity – of which investors were originally sceptical due to its opacity. The scepticism was justified, as management sold Learnosity earlier this year at a deep discount to its carrying value, recording a $25m loss on the sale.

As we wave goodbye to Learnosity we also do so to some optionality, as the sale eliminates the possibility, however small, of it becoming a star performer. On the plus side, 3P Learning's balance sheet is now brimming with $23m of net cash, after repaying all of its debt during the year. With the fling with Learnosity now over, our attention turns to 3P Learning's core business of selling its flagship Mathletics software.

A loose sail

Educational software enjoys some powerful tailwinds. Students get better learning outcomes, as gamification and automatically adjusting questions improves engagement. It also helps the teachers too, by saving them time through automated marking and insightful analytics.

By moving first, 3P Learning capitalised on these trends by signing around 50% of Australian schools as customers, receiving a recurring stream of subscription revenue for its efforts.

| Year to Jun ($m) | 2018 | 2017 | /(–) (%) |

|---|---|---|---|

| Revenue | 55.4 | 52.5 | 5 |

| APAC EBITDA | 17.5 | 15.1 | 16 |

| EMEA EBITDA | 3.3 | 3.1 | 10 |

| Americas EBITDA | (1.8) | (2.8) | 36 |

| Underlying NPAT | 7.1 | 6.3 | 13 |

| Operating cash flow | 14.0 | 14.7 | (5) |

But its growth has dried up in Asia Pacific, its most important market, with licence numbers falling by 1% over the year to 2.6m. It's likely that competition is intensifying.

The division's results were supported by a 6% increase in the average revenue per user (ARPU) to $11.16, which, along with higher copyright fees for printed versions of 3P's intellectual property, helped boost revenue and EBITDA by 8% and 16% respectively. Greater use of digitisation also helped reduce operating costs by 9%.

We expect incremental ARPU increases to support 3P Learning's domestic results for some time yet. But this strategy has its limits, and if taken too far, it will encourage customers to look elsewhere, so reigniting licence growth becomes increasingly important the further ahead we look.

Overseas expansion

Which brings us to 3P Learning's international operations, which is where most of the company's growth aspirations lie.

Expanding overseas was an acceptable risk for 3P Learning to take, as the transferability of its products lowers the risk of entering new markets – a feature not shared by businesses like banks or miners that must replicate their entire value chains in new markets. But despite these handy advantages, 3P Learning's overseas progress has been disappointing.

Licence numbers contracted in both international territories with a 12% decline to 1.5m in Europe, Middle East and Africa (EMEA) and a 15% decline to 0.85m in the Americas. Fiercer competition is likely to be the culprit again, along with a few Brexit issues in the UK.

Confusing the picture though, is the fact that the decline has been partly engineered, as management has put an end to offering school-wide deals at fixed price points based on the logic that better economics will flow from selling fewer licences at higher prices.

By selling licences on a per-user basis instead, constant currency ARPU has surged ahead in both regions – 10% in EMEA and 13% in the Americas – but it's meant that licence numbers have suffered, particularly in the US.

This is expected to be the last result impacted by ‘unbundling', which promises a clean set of numbers to measure management's progress hereon. But whether the company can grow licences remains the million dollar question.

Ramping R&D

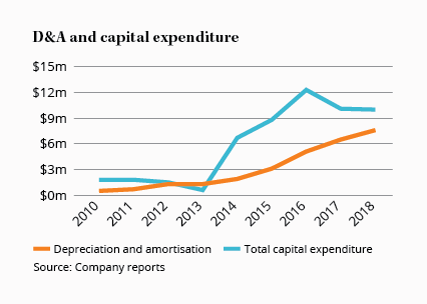

3P Learning has invested more in its products to counter soft licence growth and ward off competitors. In its last five years as a private company, it capitalised just $12m of software development expenditure. But in the four years since its June 2014 initial public offering (IPO), that figure has jumped to $40m.

That may reflect underspending as a private company (presumably to maximise the IPO price) rather than overspending as a public company, which would suggest that 3P Learning's functionality has caught up rather than surged ahead of competitors. It's possible that we underestimated the extent of the clean-up job that chief executive Rebekah O'Flaherty inherited in 2016.

Either way, with a number of issues addressed and improvements made, the company is better placed to grow overseas, as well as being more difficult to dislodge at home.

It hasn't all been smooth sailing though, as the migration to HTML from Flash has taken longer than expected and caused some usability issues along the way. But the pending release of Readiwriter phonics will broaden the product range (watch the second video on this link for a demo), and with nine Asian resellers appointed and a strengthened US management team, 3P Learning is better placed. Management is slowly becoming more confident, guiding for 'green shoots of growth in the latter part of FY19'.

The nature of 3P Learning's business model is such that even a small uplift in licence numbers would have a powerful impact on profitability. Given our improving confidence in management, and an undemanding valuation – an enterprise value to earnings before interest, tax, depreciation, and amortisation multiple of 7.7 – we figure it makes sense to bide our time to see if it eventuates.

But in order to factor in a healthy margin of safety, we won't be upgrading the stock unless the price settles below our $1.20 Buy price. HOLD.

Recommendation