The Standard Risk Measure (SRM) is a guide developed by the Financial Services Council (FSC) and The Association of Superannuation Funds of Australia (ASFA) that outlines the likely number of negative annual returns expected over any 20 year period.

The purpose of the SRM is to provide a standardised labelling system to assist investors in comparing investment options across providers, as shown below in Figure 1, FSC/ASFA Standard Risk Measure Classifications.

| Risk Label | Estimated number of negative annual returns over any 20 year period |

|---|

| Very Low |

Less than 0.5 |

| Low |

0.5 to less than 1 |

| Low to Medium |

1 to less than 2 |

| Medium |

2 to less than 3 |

| Medium to High |

3 to less than 4 |

| High |

4 to less than 6 |

| Very High |

6 or greater |

Source: FSC/ASFA Standard Risk Measure Guidance Paper for Trustees, July 2011

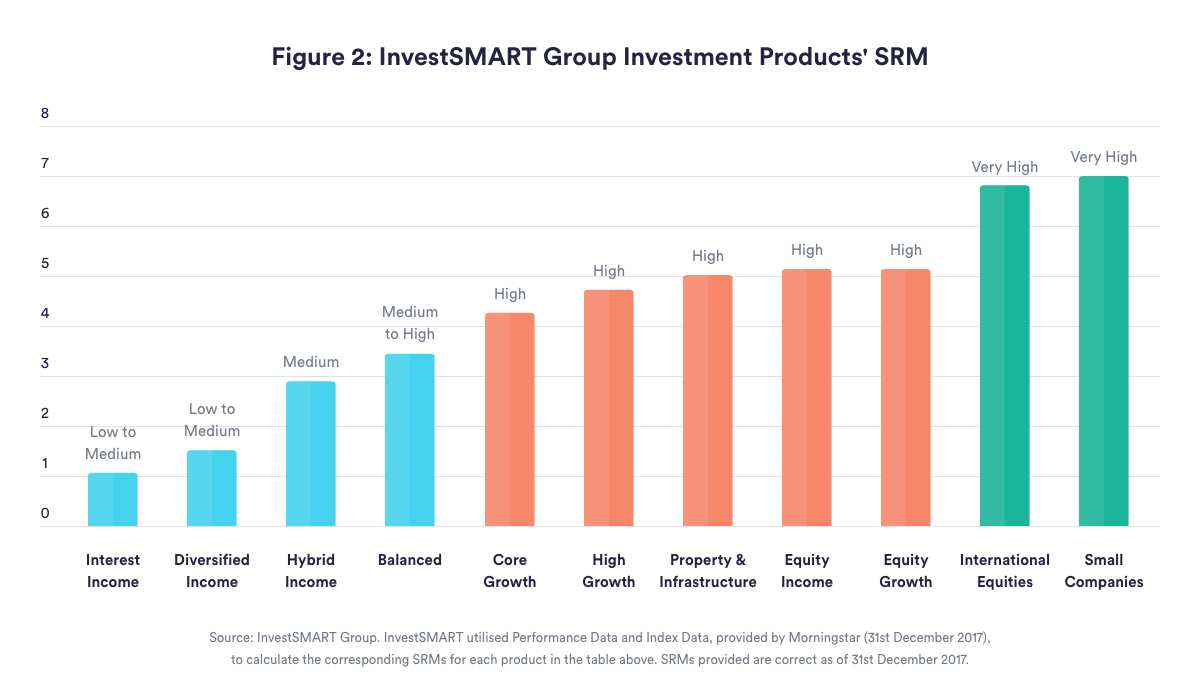

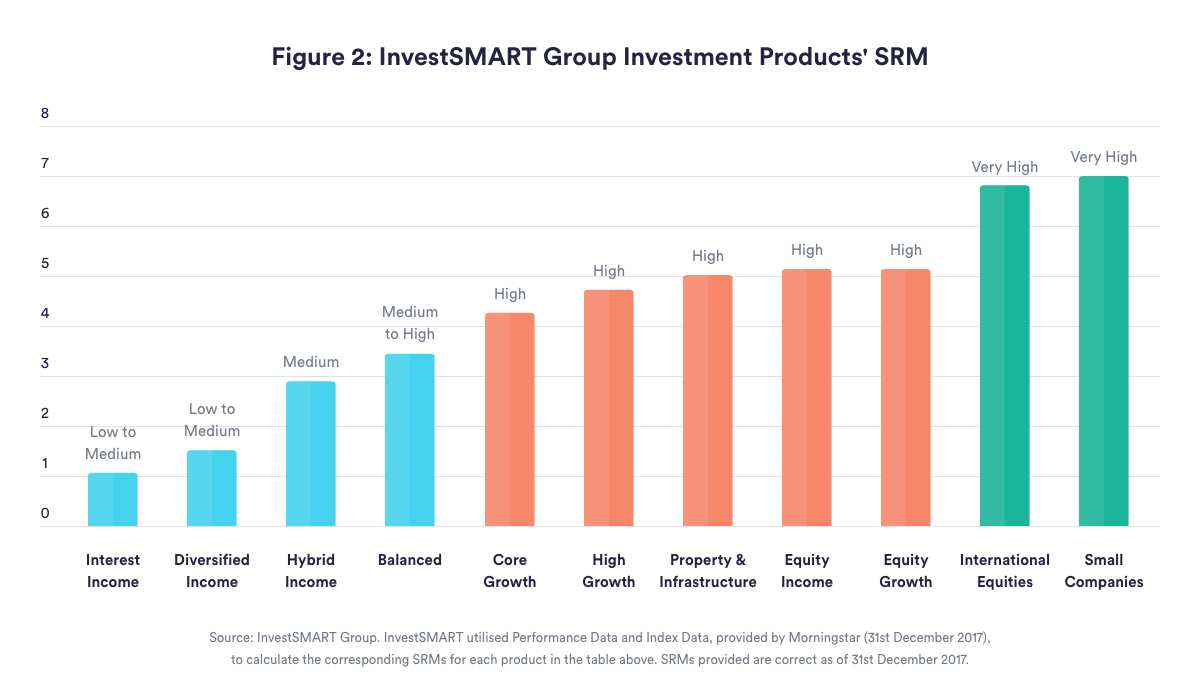

We have adopted these risk rating guidelines and applied them to our products, as highlighted in Figure 2: InvestSMART Group Investment Products' SRM:

It should be noted, however, that the SRM is not a complete assessment of all forms of investment risk. For instance, it does not detail what the size of a negative return could be or the potential for a positive return to be less than a member may require to meet their objectives. As such, it should be used as a guide and as with any investment, investors should ensure they are comfortable with the risks and potential losses associated with their chosen investment option(s). Any information should be considered general in nature and before making any investment decisions, please ensure that you read all relevant disclosure documents related to that product.

Saving for happy retirement

Saving for kids education

Saving for a property

Wealth Protection

Need help planning and finding the right investment portfolio?Get StartedBalanced Portfolio

Growth Portfolio

High Growth Portfolio

Ethical Growth Portfolio

Single asset class ETF portfoliosCash Securities PortfolioHybrid Income Portfolio

Australian Equities Portfolio

International Equities Portfolio

Property & Infrastructure Portfolio

Need help planning and finding the right investment portfolio?Get StartedConservative Portfolio Balanced Portfolio Growth Portfolio High Growth Portfolio Cash Securities Portfolio Hybrid Income Portfolio Australian Equities Portfolio International Equities Portfolio Property & Infrastructure Portfolio Ethical Growth Portfolio See all ETF portfolios How it works Capped fees Who we are Portfolios performanceETF Insights

Paul's Insights

Podcasts & videos

Portfolio updates

Top Performing ETFs

Compare Your Fund

Need help planning and finding the right investment portfolio?Get Started