Will a yield crash follow the resources crash?

Investors need to consider the state of economic, credit and sentiment cycles when buying and selling. But right now they're only looking at yield.

Like economies, sharemarkets move in cycles, ranging from the excessive pessimism seen in early 2009 to the over-optimism apparent today.

Greatly assisted by rock-bottom interest rates here and in the US, complacency about risk partly explains the expensive nature of both countries' sharemarkets. Were these risks adequately priced, markets would not be as expensive.

Unfortunately, this complacency – as noted in a recent blog post by The View from the Blue Ridge – suggests investors who pile into markets now may be doing so at or near the top.

The post discusses the trend in the number of American M&A deals exceeding $1bn, pointing out that their number has risen in recent years along with the stock market. Given that this trend was also apparent in the late 1990s before the dotcom crash and before the GFC, the conclusion is obvious; Here we go again.

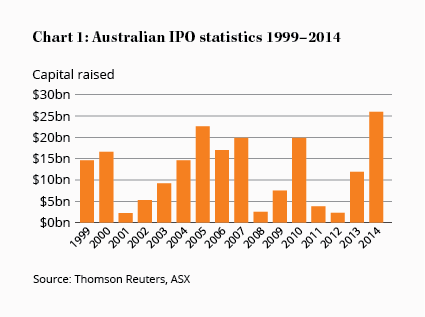

Australian data over the past 16 years display similar trends. Capital raised via IPOs - which we've used as a proxy for M&A deals - has tended to track movements in the market over this period, as Chart 1 illustrates.

Blue Ridge sensibly notes that 'investments must be made in the context of economic, credit and sentiment cycles', a position that explains why your analysts at Intelligent Investor Share Advisor suggested avoiding a number of stocks over the past few years.

Fortescue Metals (ASX: FMG), trading at $6.82 in 2010 was a good example. Iron ore prices were near the top of the cycle, although there was no way of knowing that then.

But the context of 'economic, credit and sentiment cycles' was an assessable risk. As resource prices rise more supply comes forth, eventually producing a fall in price. Under those circumstances, we reasoned, Fortescue's share price would plunge and it might struggle to refinance its debt. Both risks have materialised.

None of this required any exquisite analytical insight, only an ability to avoid the madness of crowds and an understanding of basic resource economics. Those two easily-acquired skills saved members a bundle.

Much the same goes for mining services company Monadelphous (ASX: MND). In early 2013 it was trading at $26.35, having previously appeared as one of our Top 10 businesses, based on financial metrics, not valuation, it should be noted. We haven't recommended the stocks for years.

Monadelphous is a very well run business but its price at the time assumed the mining investment boom would continue indefinitely. Again, investors got a cyclical business wrong.

After the inevitable bust, the prices of mining service companies such as NRW Holdings (ASX: NWH) and Macmahon Holdings (ASX: MAH) had declined to what we believed were excessively low levels.

We upgraded them to Speculative Buy and so far we've been wrong. Maybe this time we underestimated the extent of the sentiment against the sector as the resource boom crashed, although these calls are less than a year old - there's plenty of time for them to pay off.

But look what's happening now. Instead of learning from the experience of these stocks and making sensible assessments about the risks inherent in what remains a cyclical economy, investors are piling into yield plays like Telstra (ASX: TLS), the banks and A-REITs. Few are considering the consequences of a significant rise in US or local interest rates.

The same mistake is being made on a different field of play. Again, the context of economic, credit and sentiment cycles is being forgotten. While it's possible that rates could remain at historical lows for years, the cycle will turn sooner or later.

Instead of tethering themselves to yield and using that as a basis for making buy and sell decisions what could investors look at instead?

The answer, of course, is value, incorporating a big margin of safety for those risks not currently acknowledged. This approach would have saved investors a great deal of pain when chasing resource stocks up a few years ago. And the very same approach could save investors a lot of grief as they chase up the price of yield stocks now.