Risk weightings and portfolio weightings - part 1

If your eyes are fixed on recommendations rather than risk ratings and portfolio weightings, you may be missing a trick.

Like so much in investing, the starting point in understanding our portfolio weightings and risk ratings is to recognise the difference between price and value. We've said it a thousand times but it's worth repeating - price is what you pay; value is what you get.

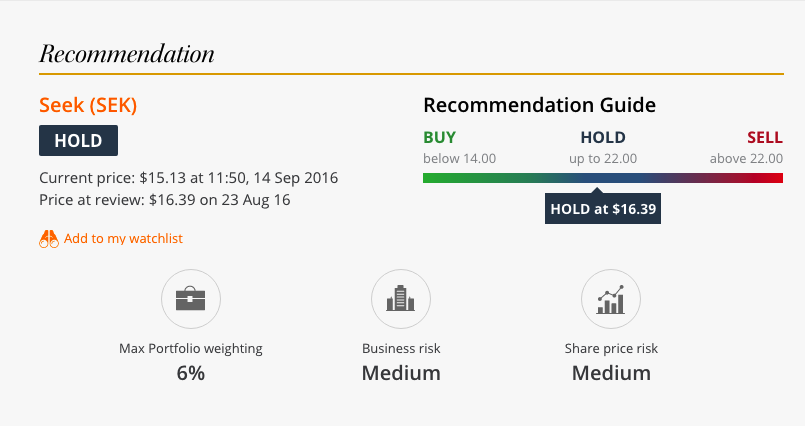

Our recommendation on a stock and the price guides attached to it – the prices at which we'd look to Buy, Hold or Sell (see image) – are all about value. If a stock's share price is far higher than our estimate of its intrinsic value then we'd probably call it a Sell.

If the reverse is true, it's likely to be a Buy. If our estimate of intrinsic value approximates to the current share price it will be a Hold. And because the market is sort of efficient most of the time, most share prices do approximate to our estimate of intrinsic value, hence the many Hold recommendations.

That's easy enough, right? The tricky bit is working out intrinsic value, which is what Intelligent Investor is all about. In statistical parlance, the underlying value of a stock is its ‘expected value' – the weighted average of all the potential outcomes. But for our purposes, think of intrinsic value as what we believe a stock to be worth.

Different types of risk

Let's now consider risk. Confusion arises from the fact that whilst there is only one form of value, there are many forms of risk. Our business risk assessment, share price risk rating and maximum portfolio weightings each address particular aspects of risk.

Let's take business risk first. This is the potential variance of a stock's value around our assessment of its intrinsic value. This would take account of the geographic and sector diversity of a company's earnings streams, as well as any perceived risks to the competitive advantages it enjoys and the value that it adds to its customers.

Added to this would be risks from a company's management, business model and strategy – so the value of a highly acquisitive company might vary according to the successful or unsuccessful integration of its targets. Also considered here would be a company's 'operational gearing' due to relatively high fixed costs, and the potential departure of key employees. Business risks will also include financial gearing arising from debt, as well as risks from currency mismatches (revenues in one currency, for example, and expenses in another) and hedging.

Share price risk is altogether different, being our best guess at the likely volatility of a share price over the short to medium term (say one to five years). It naturally takes account of a stock's fundamental risk (in a perfect market it might take full account of it), but overlain onto this is our guess at the variability of market sentiment towards a stock.

Making guesses about market sentiment is very much not our style – but business risk is often a very long-term matter and we think it's important at least to try to give you an indication of how much a stock might swing around over a shorter timescale.

Bear in mind also that our assessments of risk are in the context of equities generally – so a medium rating means medium as regards to other shares, not other investment types, such as cash and bonds.

Next week we'll look at some examples of risk ratings in practice, before also discussing our maximum recommended portfolio weightings.

To get more insights, stock research and BUY recommendations, take a 15 day free trial of Intelligent Investor now. You can find out about investing directly in Intelligent Investor portfolios by clicking here.