Paying for a Mercedes, driving a Toyota

Many investors are paying more in fees than they need to. And it's destroying their future wealth. A new white paper shows you how to get fees down and returns up.

The above headline, coined by InvestSMART chairman Paul Clitheroe, is an apt description of the average Australian's experience of the finance industry. It's a colourful and useful metaphor, if a little harsh on Toyotas. But it doesn't quite reveal the depth of the problem.

If you pay for a Mercedes but the salesperson hands you a "T" shaped key you'll know something is amiss soon enough. In finance, it can take years, decades even, before realising one has been sold a dud. For many, it will be too late to do anything about it.

For the last two months I've been working on a white paper called How Fees Can Destroy Your Wealth - Understanding The Total Cost of Investing. What follows are the highlights of this research and a call to read it in full before passing it on to friends and family.

The wonders of being average

The title points the way towards the principal finding - that the financial interests of most investors are best served not by trying to beat the market, and paying higher fees in the process, but by paying the lowest possible fee for merely average returns.

That's not what the industry would like you to know but it's the truth.

For someone that has devoted the best part of 20 years to helping self-directed investors beat the market through value-based stock recommendations, the conclusion might seem odd.

But personal experience has led me to believe that most people are not cut out to managing their own investments. Sadly, the evidence suggests that the people that do profess such an ability - fund managers and advisors - aren't cut out for it, either.

The result is that to get their returns up, most investors should focus on getting their fees down.

Bait and switch

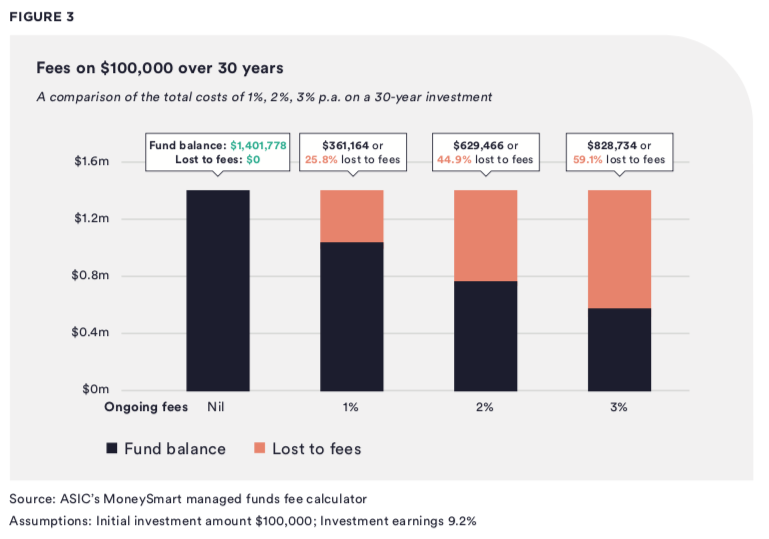

The white paper reveals the huge cost of paying for performance investors rarely get. Over 30 years, someone paying annual fees of 3 per cent sacrifices 59 per cent of what their portfolio would have been worth had they paid no fees at all. Even fees of 1 per cent a year result in a 26 per cent sacrifice.

The industry's bait-and-switch model perpetuates this theft. On the basis that you get what you pay for, investors are encouraged to believe that high fees will lead to high performance. The evidence suggests the opposite.

According to InvestSMART research, of the 7,327 active managers that attempted to beat their benchmark index over the 10 years to June 2018, 78 per cent failed to do so. The average fee for achieving this underperformance was 1.74 per cent. The average underperformance was 1.88 per cent.

Notice how the extent of the fees paid approximates to the magnitude of the underperformance. This makes inherent sense. Despite the growth of index or passive investing, actively managed money still dominates. Basic maths teaches us that it's hard to beat the average when you are the average. Most active managers, therefore, get average returns minus the fees charged for outperformance that doesn't usually occur.

In other words, the bait - Mercedes-style outperformance - is rarely delivered; the switch is to Toyota-style average returns, minus the fees.

If this were an ordinary industry such a model would not endure. Unfortunately, Australia's low levels of numeracy, disengagement from our own finances and the lack of understanding of the effects of compounding makes us easy prey for an industry that prospers from small numbers having big impacts. The chart below reveals just how big these impacts can be over time:

Reduce your fees

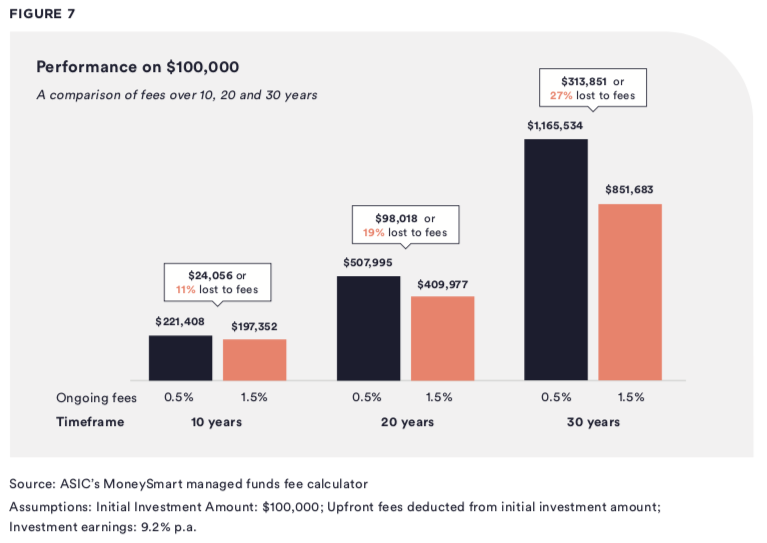

Reducing your annual fees from 1.5 per cent to 0.5 per cent will result in significant savings. And the longer your investment time frame, the more those savings mount.

The white paper explains in detail why the extra cost many investors pay isn't worth it, unveils the endemic fee stacking that bedevils the sector, and explains five ways to reduce your fees.

The research won't be for everybody. Intelligent Investor members may inherently understand the brutalising effect of fees on returns, which is why they have decided to manage their own money.

If you are one such reader, maybe you can do your friends and family a favour. Ask them if they know how much they're paying in total fees and how they eat into returns. Are they aware of the impacts of compounding over time. Are they, in effect, paying for a Mercedes but driving a Toyota?

You can download the white paper here. It's free and, we hope, insightful. Please share it with anyone you think will benefit.