Lessons for all in the education sector

The dodgy behaviour in the vocational education space has set some of the ASX-listed survivors up for success.

Pop quiz. When making an investment, which industry would you pick from?

1.) A growing industry

2.) A stagnant industry

My guess is that most investors would select option 1, on the basis that a growing industry offers an increasingly bigger pie for the business to feast on.

The trouble with that is that growing industries attract competition and, as we argued in Cloud computing floats heading for trouble, if the industry's growth is outpaced by a rise in competition, it can mean little for investors.

The holy grail is not simply industry growth, but industry growth without incremental competition. But where do you find that?

Well, one area could be international education.

Australia is a world leader in the space. We have a developed, English-speaking economy located in close proximity to Asia, along with a comfortable climate, a good record for safety and an attractive way of life. This places us in the top four education destinations alongside the US, the UK and Canada.

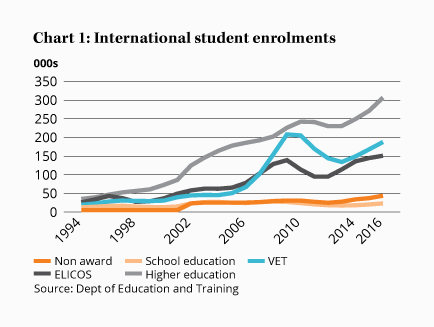

These factors have led to double digit international student growth for decades, as shown in Chart 1. And it shows no signs of slowing.

But instead of attracting new competitors, an enormous number have left the industry. Most of them have been the dodgy vocational education companies.

In 2014, the rorting of the Federal Government's VET-FEE-HELP funding scheme started to hit the headlines. Instead of providing quality education, cowboy operators maximised enrolments to enrich themselves with government funding.

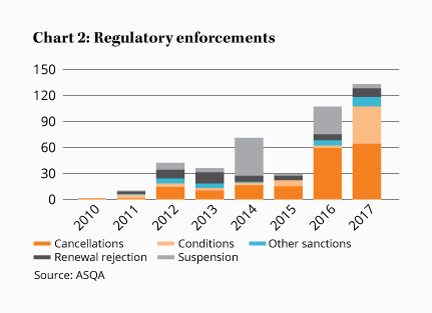

A regulatory crackdown ensued leading to the closure of many schools, as shown in Chart 2.

Listed providers like Vocation Limited, Australian Careers Network and Intueri entered administration and others like Site Group (ASX:SIT) and Ashley Services (ASX:ASH) closed their schools. This removed around $400m of capacity from the market, with multiples of that removed from the closure of privately owned schools too.

For the quality operators that weathered the storm, the future is looking brighter. We've even heard murmurs of schools turning away students because they can't keep up with demand.

Industry behemoth Navitas (ASX:NVT) stands to benefit with the reputation and resources to capitalise on the opportunity. We formally cover this business and you can see our recommendation by signing up for a free two-week trial here.