Four ways to spot fake news this reporting season

Statistics can be persuasive, but watch out for these popular management tricks.

There's a 99.73% chance you will read false and misleading statistics this reporting season. Most chief executives are good people making the best use of their power, but – whether through malice or bias – there are plenty who are willing to sugarcoat facts or misuse data to put their company in a more favourable light. Spotting ‘fake news' isn't always easy, but here are a few things we look for each reporting season:

Chart tricks

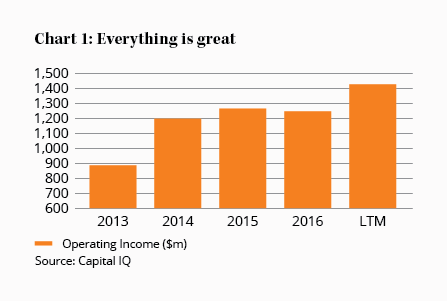

One of the more common ways management will try to bamboozle you is by misusing charts. Take a look at Chart 1, which shows QBE Insurance's (ASX: QBE) operating earnings over the past few years. There's clearly a growth trend, right?

We made this chart, not QBE's management, but whenever a chart is presented to you always check the axes because the scale can easily distort a trend. If management wants to make small changes look large, they will reduce the scale.

We made this chart, not QBE's management, but whenever a chart is presented to you always check the axes because the scale can easily distort a trend. If management wants to make small changes look large, they will reduce the scale.

Another trick is to narrow the range of years to exclude unfavourable histories. You can see the difference when you compare Chart 1 and Chart 2: both charts use the same raw data, but a little tweaking of the X- and Y-axis can distort the message.

Poor Context

Another trick is to take a genuine statistic out of context. Cochlear (ASX: COH) is a well-managed, high-quality company but one slide of their most recent presentation rubbed us the wrong way. To describe the ‘Hearing loss market opportunity', Page 6 of the 2017 results presentation reads in point form: ‘360m people worldwide suffer from hearing loss. 37m could benefit from a cochlear implant. <5% market penetration'.

Management left off one huge bit of fine print: a cochlear implant and the necessary surgery costs around $40,000. Hearing loss worldwide is irrelevant because 71% of the world population live on less than $10 a day. The majority of people with hearing loss worldwide will never be able to afford a cochlear implant. Cochlear does have a large market opportunity, but there's no need for management to exaggerate it beyond the developed world, where the company can actually sell its products.

Management left off one huge bit of fine print: a cochlear implant and the necessary surgery costs around $40,000. Hearing loss worldwide is irrelevant because 71% of the world population live on less than $10 a day. The majority of people with hearing loss worldwide will never be able to afford a cochlear implant. Cochlear does have a large market opportunity, but there's no need for management to exaggerate it beyond the developed world, where the company can actually sell its products.

A valid statistic needs to be more than just accurate, it must be relevant.

Benchmark flip-flopping

Accounting is the language of business, and one that's often abused. In 2015, Nanosonics' (ASX: NAN) management reported ‘First quarter sales up 56% on prior quarter to $6.5m'.

Wow. By convention, though, almost all companies report sales growth relative to the prior corresponding period – that is, the equivalent quarter last year – not relative to the quarter directly preceding this result. The reason is that reporting one quarter to the next may contain seasonal distortions or short-term effects.

In this case, Nanosonics' directly preceding quarter was unusually depressed. If Nanosonics had opted for the conventional approach as it had done historically, sales would have increased only 7%. Thankfully, management hasn't pulled that trick again but it's a reminder to watch for changes in reporting periods or the use of new benchmarks.

Cherry picking

It's natural for management to want to show the company in the best light, but avoid those that give very narrow examples of something positive while being quiet about the big picture.

Blackmores' (ASX:BKL) 2017 annual report gushed: ‘Blackmores is a clear leader in the area of research and development and we have supported this with increased investment in the Blackmores Institute'.

Blackmores may have increased its investment in the Blackmores Institute, but that's just one cookie in the jar. The overall research budget was cut by $7m in 2017 and research spending has almost halved over the past five years (while the marketing budget more than doubled, we might add).

Cherry picking data is one of the easiest ways for management to fool investors and the only way to avoid it is to read widely and thoroughly to ensure you're getting the big picture. Good managements tend to use matter-of-fact language and don't sugarcoat bad news or manipulate data being presented to shareholders. Anything else, and it might suggest management is trying to mislead you.