Disappointed you missed this tenbagger? Don't be.

BlueScope Steel's stock has risen more than 900% since hitting bottom in July 2012. Here's why I don't care I missed it, and why you shouldn't either.

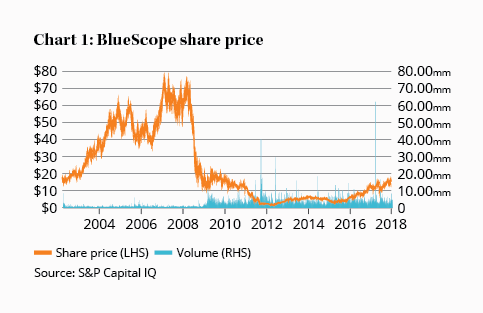

In July 2012 the share price of steel manufacturer company BlueScope Steel (ASX: BSL) hit $1.50. Fast forward to today, and the stock is $15.54. In Peter Lynch's parlance, BlueScope Steel is a ‘ten-bagger' – a stock that has risen tenfold.

Normally we seek out stocks that could be ten-baggers. They're relatively rare, though, and you might only buy a couple in a lifetime. I've been investing for 25 years, and I'm yet to have my first (although my 14-year holding in Cochlear (ASX: COH) is just a hair's breadth away).

However, not all ten-baggers are created equal. If we jump back to when BlueScope Steel – then known as BHP Steel – listed in July 2002, the accompanying chart shows us the stock is still below its price back then. The return doesn't look quite so enticing now does it?

It's easy to explain BlueScope's peaks and troughs because of the type of business it is. It's highly cyclical, so it will benefit from good conditions and suffer during bad. The company is also capital intensive, which means it must continually invest a lot of cash in new plant and equipment to ensure it remains competitive.

Highly cyclical and capital-intensive companies – like most steelmakers, airlines, building materials and printing companies – are low-quality businesses. Over the (very) long term, this means they tend to perform worse than businesses that are less cyclical or capital intensive.

Overconfident management

Their fundamental disadvantages are often exacerbated by poor management. Overconfident management teams frequently spend too much on capital expenditure and make debt-funded acquisitions during booms. Invariably that's when the companies are swimming in cash.

Take BlueScope Steel today, for example. Management is arguably being a bit more sensible this time, because capital expenditure is lower than it was during the 2003-2008 boom. Debt is lower too. But the fact the company produced free cash flow of about $750m in 2017 is strong evidence there's a boom underway.

This is the problem with cyclical and capital-intensive businesses. They often look like good businesses just when they're most dangerous to shareholders. For BlueScope that time is now.

| The chart has been adjusted for BlueScope's 6 for 1 share consolidation in December 2012. If you reading our old reviews, however, you'll need to multiply the review prices before December 2012 by six to get a price comparable to today's. |

Ironically, ten-baggers are probably more common among weak businesses precisely because the share price troughs are so deep and the peaks so lofty.

If you want to invest in the ‘poor business' space, there's certainly nothing stopping you. As BlueScope shows, if you get the timing right you can make a lot of money.

Mistakes are worse

But mistakes are generally much worse. It's difficult to pick cycles and, when things go wrong, the risk of permanent loss of capital is much higher.

Former colleague Gareth Brown covered both major steelmakers – BlueScope Steel and Arrium – near the bottom in 2012. In that review he stated that BlueScope Steel ‘looks quite cheap'. But had you owned Arrium instead – Gareth said ‘Avoid' – you would have done your dough when that company entered administration in 2016.

Gareth's consistently negative view of BlueScope over the 2003-2007 period was eventually proven right, with the stock plunging 98% peak-to-trough between 2007 and 2012. But the price of that was significant negative criticism as the stock price soared during the boom.

If you favour good businesses you'll often appear ‘out of touch' during the good times. The very nature of poor businesses is that their stock prices can make you look silly for years. But in most cases the weaknesses reveal themselves eventually.

So what are my tips if you want to stick to owning good businesses?

What's a good business?

First, you need to learn what a good business is (not everything Intelligent Investor recommends is). It's a topic for another time, but good businesses generally produce strong free cash flow, are able to reinvest capital at high rates of return, and can generally grow without needing significant external capital (debt or equity).

Second, avoid confusing strong-performing stocks with good businesses. They're two very different beasts. Analyse the business over 10 or even 20 years, as five years might not be long enough. Cyclical upswings and other temporary tailwinds can make a company look better than it is. Remember too that good businesses can weaken over time – InvoCare (ASX: IVC) is a recent example.

Third, you need to conquer FOMO (fear of missing out). If you want to be more discerning, you need to care less about stocks that are simply ‘going up' – like BlueScope Steel has been. Instead focus on buying strong businesses at reasonable prices and, over time, compounding will do the work for you.

Investing in strong, high-quality businesses is the way to get rich slowly. Unfortunately too many people buy weaker, higher risk companies that don't suit their risk profiles. These days I rarely buy anything other than high-quality businesses and my portfolio performance has been the better for it (see also Lessons from the past two-and-a-bit years).

If you buy weak businesses, you might benefit for a while. But when the favourable breeze turns you can quickly find yourself struggling to stay upright. Quality companies have the wind at their backs and your portfolio will be more resilient for their presence.

Disclosure: The author owns shares in Cochlear and InvoCare.