Bank shares versus hybrids

Key Points

- Bank share prices have surged since June, with yields much lower

- Margins on bank hybrids have improved

- As a result, a partial switch from ordinary shares to hybrids may be in order

The background

Initially at least, hybrid offers like grossed up). Critically, they're now comparable with those offered on the convertible hybrids, each of which is currently trading (or is being offered) on a grossed up yield of 7-8%pa.

The convertible hybrids still feature high yields, downside risk and no ordinary share upside (earlier articles contain the full analysis) but right now, bank ordinary shares offer lower yields and much less upside than they did a few months ago.

So, should you make the switch?

The arguments in favour are:

-

Comparable yields. Table 1 shows how bank ordinary shares and hybrids now trade on comparable yields, eliminating one of the main arguments in favour of ordinary shares. Going forward the yields will be affected by different factors. Hybrid dividend (coupon) payments—typically floating rate—will drift down if short-term interest rates continue to fall (and vice versa) whilst future dividends on ordinary shares will primarily be a function of bank earnings, which may be hurt by higher interest rates (see below). But a switch to hybrids doesn't have to involve the same yield sacrifice it did previously.

-

Less downside risk. Whilst hybrids share many of the 'serious downside' risks of ordinary shares—both would be likely to suffer complete capital loss on a bank insolvency—they are less influenced by general market movements or falls in the price of the ordinary shares. The Maximum Conversion Number mechanism means hybrid holders are likely to suffer capital losses if the price of the ordinary shares drops by more than 50% or 80% from the original issue date (depending on the hybrid). But ordinary shareholders will have already racked up massive losses by that point.

- Reduced upside on ordinaries. Hybrids don't have the upside of ordinary shares but the recent run up in bank share prices close to all-time highs reduces the likelihood of further massive increases.

Hybrids currently offer similar yields, more downside protection and a lower risk of missing out on any upside. Should you consider switching from bank shares and lock in some of the recent profits?

Bank shares

Intelligent Investor has for some time warned about bank share price valuations and advised readers to limit their bank exposure. Let's take a different tack.

Unemployment and interest rates are key factors in credit expansion and, by extension, bank earnings and share prices. Lower unemployment and interest rates mean more loans being written and fewer going bad.

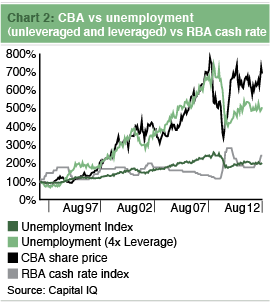

Chart 2 examines this relationship since January 1992, showing how changes in the Commonwealth Bank share price relates to movements in indices (created by us) of the unemployment rate and the RBA cash rate. An increase in each index reflects a fall in the underlying rate (and vice versa).

Up until 2008, the correlation between the CBA share price and changes in unemployment was astonishingly high (over 90%). Since 2008, bank-friendly stimuli and ultra-loose monetary policy has broken this 16-year relationship.

CBA's share price now trades far above where the 'unemployment indicator' historically suggests it should.

Interest rates near record lows are finally making their mark. For the moment at least, bad debts are being kept at bay, forcing savers out of cash and into higher yielding assets (like CBA shares), driving up prices.

For investors in products such as capital gains tax.

If you are looking to reduce risk further (but not willing to accept term deposits or bonds) you might also consider the recent ANZ or NAB subordinated note offers, or earlier income securities, although these offer a lower yield.

If you're a wholesale investor (who can buy in $50,000 or $100,000 minimums), consider the unlisted hybrids offered by institutions such as FIIG. Just remember that term is a big factor in looking at alternatives, since many of them only have a year or two left to run (making them more of a term deposit, rather than share, alternative).

In a nutshell

If you're a big bank fan and believe share prices will continue to rise, by all means hang on to your ordinary shares. But if you've been mainly investing for the yield, consider taking profits and making, at least, a partial switch to hybrids.