Argo launches infrastructure LIC

Key Points

- LIC focussed on global infrastructure

- High fees

- Wait for discount to NTA

Earlier this month, the RBA cash rate hit a record low of 2.0% and recent speeches suggest it will stay low for a while yet. With few places to park money at decent returns, investors have flocked to higher-yielding infrastructure stocks.

‘Yield seeking’ has paid off, too. The All Ordinaries index has increased 6% over the past year, while the Utilities Index increased 12% and the Telecommunications Services Index rose 20%.

So you can see why Argo Investments thinks the time is right to float a new listed investment company (LIC) to be called Argo Global Listed Infrastructure.

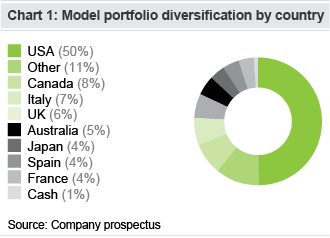

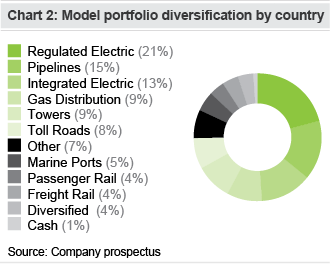

The LIC plans to raise between $200m and $600m in an offer that closes on 19 June. The money will be invested in 50–100 international pipelines, ports, airports, roads and telcos, with up to 20% of the portfolio in infrastructure bonds and up to 5% in cash (see Charts 1 & 2 for forecast diversification by country and sector). Borrowing money to boost returns isn’t permitted, though derivatives may be used, including the ‘opportunistic sale of call options on up to 20% of the Portfolio and put options on up to 10% of the Portfolio’.

Argo Investments is the manager of the company and will own about 12.5% of the shares, but it will stick to the administration and appointment of a portfolio manager, rather picking stocks itself.

That job will fall to Cohen & Steers Capital Management, a specialist in long-life assets such as infrastructure and real estate, which currently has $71bn in funds under management. Similar funds managed by Cohen & Steers have outperformed their benchmarks by 1.7–3.5% since inception, albeit with absolute returns of only 7.9–10.1% over the past 10 years. With yields on infrastructure stocks now significantly lower than they were a decade ago, Cohen & Steers will have a hard time matching those returns with Argo Global Listed Infrastructure.

High fees

What’s more, the annual management fee of 1.20% is on the high side – especially given that it’s roads and pipelines being managed, with a total return to investors unlikely to reach double digits. Compare this to the 0.47% charged by the index-hugging iShares Global Infrastructure exchange traded fund (ETF).

A 0.73% difference in fees may not sound like much but the value you’re willing to place on the LIC should take it into account. If you’re only expecting returns of 7–8%, then you’re giving up an extra tenth of your return and, all things being equal, you should be prepared to pay 10% less. All told, the fees of 1.2% amount to about 16% of your total return, so you’d want a discount of 16% against net asset value to claw it all back.

This is why we generally avoid investing in LIC floats. Argo Global Listed Infrastructure has a subscription price of $2.00 per share, but after broker fees the portfolio manager will only have approximately $1.967 to invest. Rather than buying with the discount it deserves, you’re actually paying a premium.

As is common with LIC floats, subscribers will be given a ‘free’ option to purchase an extra share at $2 by March 2017. But whether you issue a lone share or a share with 5000 attached options, the value of the fund will still be $1.967 for every $2.00 put in. The attached option reduces the value of the shares due to the risk of future dilution. There’s no free lunch here.

We might be interested in Argo Global Listed Infrastructure should its share price fall well below its net tangible assets, but for now we would prefer to own infrastructure stocks directly and bypass the fees.