Flight Centre's ongoing evolution

Recommendation

Evolution is an astonishing concept. If you could travel to the distant past you could 'meet' the ancestor you share with your family's dog.

Companies evolve too, although without genes and over much shorter time periods. Take Flight Centre, for example. Like homo sapiens, Flight Centre has been super-successful, growing net profit from $15m in 1997 to $257m in 2015. According to the 2015 annual report, Flight Centre hopes to evolve from its origins as a 'travel agent to [the] world's best person to person travel experience retailer'.

The 'person to person' bit matters. Much like the family dog, Flight Centre is marking its territory as the 'non-internet' segment of the travel market. While you can now book flights at www.flightcentre.com.au and the company is developing closer ties with discount airlines like easyJet, Jetstar and Tiger, these initiatives aren't its core market.

Key Points

Internet threat remains vague

Corporate travel business growing fast

International business becoming significant

Person to person travel bookings are where Flight Centre makes most profit and, so far at least, there's been little evidence that internet-based bookings are hurting its business. This may change of course; we've been talking about the internet threat for years – see Flight Centre: Shops v Internet from 14 Nov 11 (Hold – $19.72). But that review and others show we've been too conservative, and online growth in some industries – wagering, for example – doesn't appear to have threatened established players very much at all.

Flight Centre has already demonstrated it can evolve over time. In fact, there are two avenues for future growth that might help ward off internet Armageddon entirely.

The first should be well-known to shareholders. The company's corporate travel division, in which Flight Centre manages other companies' travel arrangements, has been a great success. Corporate travel now represents 34% of Flight Centre's total transaction value (TTV), up from 23% in 2009.

Growth from corporate travel continues to eclipse retail, with a 16% increase in TTV in 2015. Recent corporate travel acquisitions such as Koch Overseas de Mexico also show management remains committed to the market segment. For more on corporate travel, see Flight Centre's split ticket from 28 Jan 15 (Hold – $37.43).

Sleeping satellite

The second growth avenue is a bit of a sleeper. In fact, it has received much less attention from us than corporate travel, although its growth became more obvious in Flight Centre's 2015 results.

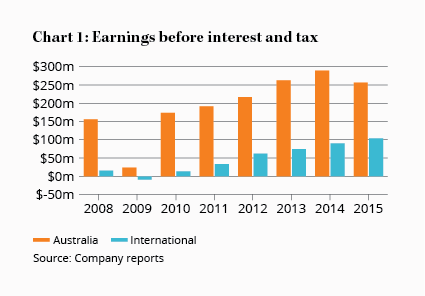

Chart 1 shows that the company's international business has increased earnings before interest and tax (EBIT) from $16m in 2008 to $104m in 2015. In fact, the international operations now produce 29% of Flight Centre's total EBIT (although Chart 1 also shows Australia remains the largest business by some way).

Following formerly true-blue companies like Computershare and Sonic Healthcare, Flight Centre is spreading its wings and expanding globally. It now operates in 11 countries, which you can see in Table 1. With the exception of Canada – which is in recession – all countries produced a profit in 2015.

True, some are more profitable than others. Table 1 shows the net margin produced by each business. The UK & Ireland segment is the second-largest business internationally but the most profitable. On TTV of $1.9bn, the UK & Ireland business generated EBIT of almost $50m, a net margin of 2.6% (only slightly below the 2.7% generated in Australia).

The USA, Flight Centre's largest international business by revenue, is less profitable. In fact, the USA has been generally disappointing since the company acquired Liberty Travel in February 2008.

USA improving

But the division finally seems to be improving. On TTV of $2.5bn, it produced a net margin of 0.9% in 2015. While that's significantly lower than Flight Centre's other international businesses – due to a lack of volume commissions in the US – it is at least getting better. Managing director Graham Turner thinks the USA division can move to a 1.5% net margin over time by focusing more on long-haul travel (as the company does in Australia).

| Country | TTV ($m) | EBIT ($m) | Net margin (%) |

| Australia | 9,600 | 256.7 | 2.7% |

| UK & Ireland | 1,900 | 49.5 | 2.6% |

| USA | 2,500 | 21.4 | 0.9% |

| Canada | 1,200 | (3.9) | (0.3%) |

| New Zealand | 883 | 15.1 | 1.7% |

| South Africa | 473 | 11.3 | 2.4% |

| India | 386 | 3.5 | 0.9% |

| Great China | 232 | 2.3 | 1.0% |

| Singapore | 167 | 2.8 | 1.7% |

| Dubai | 85 | 1.7 | 2.0% |

What seems certain is that Flight Centre, relatively mature in Australia, will grow its international businesses over time (including by acquisition). Some growth will come from expanding its corporate travel businesses overseas, so the two growth avenues aren't mutually exclusive.

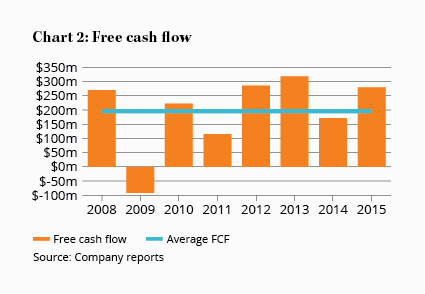

For a company with such a phenomenal long-term record and, given that it can keep expanding both internationally and in corporate travel, a PER of 15 does not seem expensive. Particularly as the company has produced free cash flow averaging more than $260m over the past four years (and almost $200m over the past eight years). Over four years that equates to an average free cash flow yield of almost 7% on the current market capitalisation.

The reason for not upgrading now depends less on the threat from the internet and more about where Australia is in the economic cycle. The past four years have truly been the best of times for Flight Centre, with a strong economy and, importantly, a strong Australian dollar. This period isn't necessarily typical.

If you chart Flight Centre's free cash flow back to 2008 – see Chart 2 – the company looks rather more cyclical. In 2009 the business suffered as the global financial crisis hit. The stock sank below $4.00, a price that looks crazy-cheap in hindsight.

Cheaper price

That price is long gone, but the lesson is important. An economic downturn – or less favourable conditions – could hit the company hard. In summary, we'd rather wait for a slightly cheaper price.

Whether we'll get an opportunity this financial year is difficult to tell. Management forecasts 4-8% profit growth in 2016 but the weak Australian dollar could yet cause disappointment. We're maintaining the recommendation price guides for now given past share price volatility but might upgrade above the current Buy price of $30.

What has become clearer is that Flight Centre is a better business than it gets credit for. The company is evolving to become an integrated travel retailer, the threat from the internet is perhaps a little less than imagined and, given time, the international businesses could become much larger.

The stock is up 5% since Flight Centre: Result 2015 from 27 Aug 15 (Hold – $36.01). It remains a HOLD but keep this evolutionary wonder on your watch list.

Disclosure: The author owns Computershare and Sonic Healthcare, and has owned Flight Centre in the past (and hopes to own it again).

Recommendation