The risk of new "bail-in" hybrids

My commentary this week runs along my rather common theme of late: Hybrids, their complex structures and inherent risks. I do not want to sound like a cracked record; however, I believe this is an area that deserves some attention. Particularly as there is a lot happening in this space, whether it is in the form of overseas regulators changing their policy on hybrids, CBA’s most recent PERLS VI issue or recommendations from the Murray inquiry – these items are creating a new landscape which all participants must navigate and be aware of.

There are an estimated 75,000 consumers invested in hybrids in Australia. A recent survey conducted by the Australian Securities and Investments Commission (ASIC) found that 85% of retail investors in hybrids rated their overall understanding of the convoluted instruments as average or better. However, the general consensus by regulators (including ASIC) and commentators here and overseas is that equity hybrids are complex, misunderstood and mispriced.

The problem with these hybrids is that they were specifically designed to provide financial support to banks if they have another financial crisis like the 2008/09 GFC. That is, they will convert to equity, without investor choice, at precisely the wrong time for investors.

Many in the market believe the hybrids will only convert when the bank becomes bankrupt but this is not how the regulator views it, they see this capital converting when the bank is in trouble but still 'a going concern' and investors in these new securities will likely take a significant haircut on their capital when they convert.

It is important to understand that these securities are designed to be equity in the eyes of the banking regulators. During the GFC, several European banks were bailed out by governments which, in effect, saved the banks from failing, but laid the burden of loss at both the equity holders’ door and taxpayers.

Bond investors were protected (as they should be) because they ranked higher in the capital structure. In Australia, the taxpayer was burdened with having to provide a deposit guarantee. If the same scenario played out today, the banking regulator would have the option of declaring non-viability and forcing a conversion of these hybrids to equity – good for the taxpayer but not so good for the hybrid investors.

This was the birth of the ‘new style’ Basel III compliant hybrids. They were effectively tweaked to be made riskier through the inclusion of new terms that automatically trigger a conversion in ordinary equity, or give APRA the right to convert, or in extreme cases, cancel the securities altogether.

Banking regulators are now encouraging banks to issue more "Tier one" capital, i.e. "equity" to avoid a repeat of this scenario. It is a classic market arbitrage because hybrids are cheaper for banks to issue than shares which would dilute their return on equity, regulators accept them as regulatory capital because they can be forced to convert into equity while investors unwittingly price them as debt. But rather than issue expensive equity and ultimately dilute existing shareholders, the banking sector designed these hybrids to take advantage of a market arbitrage.

Ironically, it is now the same regulators that are warning that the risks of these securities are not being properly priced. The Bank of England recently warned: "There is a risk that investors are underestimating the probability that [these] instruments will be required to absorb losses". Then UK regulator, the Financial Conduct Authority, this month banned their issue to retail investors while the EU equivalent, the European Securities and Markets Authority, has flagged it is likely to follow.

The biggest risk is what happens when markets sense that a bank’s financial position is deteriorating toward a point where non-viability may be called by the regulator and investors start a sell down of the hybrids, which will occur well before any actual crisis triggering a non-viability clause.

You just have to look at the sell down that occurred in 2008/09, when even the major banks’ hybrids dropped by more than 30 per cent without any question of default of the banks.

What we don’t know yet, is what will happen in the next financial crisis when these new bail-in hybrids are put to the test. Many market specialists, including FIIG, are warning that the new hybrids could fall much further than 30 per cent, and potentially even more than equities if investors dumped the hybrids ahead of conversion. Recently FIIG have warned that a sell down could occur sooner than many expected if ASIC followed the UK example and banned retail distribution.

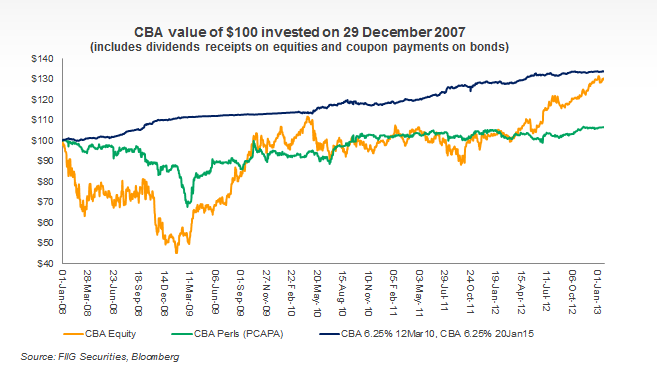

It is worth noting in the above chart how the CBA senior OTC bond performed against the PERLS (PCAPA) during the GFC. The hybrid never made up all its ground against the senior bond. Given the risk profile that a hybrid exudes versus the OTC bond, you would expect the hybrid to outperform, but it does not. During 2008/09 bank equities fell by 40 per cent on average, but you accept that risk because you also have the chance for upside, as investors that held on to their bank stocks have now found. With these hybrids, you get neither the protection of bonds nor the upside of equities.

Since the global financial crisis, hybrid products have become more complex, more like equity and more popular than ever with SMSF investors. They are not fixed income in any traditional sense – they have no set maturity date, have optional interest payments and can be converted to shares by the banking regulator.

There are clear signs globally that professional investors are sceptical about the value these new hybrids offer. However, private investors are still chasing yield, and without access to other investments offering security and high yield, will continue to support these risky hybrids.

I’d like to conclude with a quote from Benjamin Graham, who in 1949 wrote the first edition of his classic book The Intelligent Investor. Benjamin Graham is often referred to as ‘the father of value investing’ and the mentor of Warren Buffett, who said The Intelligent Investor is “by far the best book on investing ever written”. In the book, Graham writes about the structure of preference shares:

“Really good preferred securities can and do exist, but they are good in spite of their investment form, which is an inherently bad one … the preferred holder lacks both the legal claim of the bondholder and the profit possibilities of the common shareholder.”

He goes on to note the reasons why investors buy preference shares:

“Many investors buy securities of this kind because they need income and cannot get along with the meagre returns offered by top grade (investment grade) issuers. Experience clearly shows that it is unwise to buy a bond or preferred which lacks adequate safety merely because the yield is attractive.”

On when to buy preference shares, Graham argues:

“Experience teaches that the time to buy preferred stocks is when their price is unduly depressed by temporary adversity … in other words, they should be bought on bargain basis or not at all.”

In the current times of low interest rates and low economic growth, many Australian investors are building their exposure to hybrids unaware of the risks they are taking.

Benjamin Graham warned of many of the above problems as far back as 1949. Investors then and still today chase yield in bull markets, sacrificing protection measures like covenants in the process. Value investors following Graham’s advice will take advantage of the current low yields on Australian hybrids to sell down their positions and realise substantial capital gains. If Graham’s comments on the cyclicality of hybrids again prove to be true, then they may once again be available at bargain basement prices.

FIIG can offer portfolio review services if you would like to have your current hybrid holdings evaluated and recommendations made based upon the merits of the securities and the issuer.

If you would like to discuss this article or look at what sort of alternative OTC bonds with comparable yields are available to switch into – please feel free to contact me directly.