Markets in Review: The art of the deal

- US-China trade relations continue to disintegrate, with the Trump Administration this week signing off on the ~$US200 billion worth of tariffs proposed in June. They will come into effect on September 24 at a rate of 10 per cent, before scaling up to 25 per cent on January 1. (Note that the President doesn't want to impact consumers ahead of the November mid-terms and Black Friday trading.)

- Above is the statement from the President. The ‘Art of the Deal' nature of the last line is particularly interesting, as China was always going to retaliate, and has already done so. On Wednesday, China enacted its own tariffs on ~$US60 billion worth of US products including wheat, steel and LNG – which is a positive for Australian LNG providers, considering our LNG will appear cheaper. The major take-away from all this is that further escalation is likely imminent, and one has to expect that by June next year, the US will likely have a tariff on every Chinese product imported into the US.

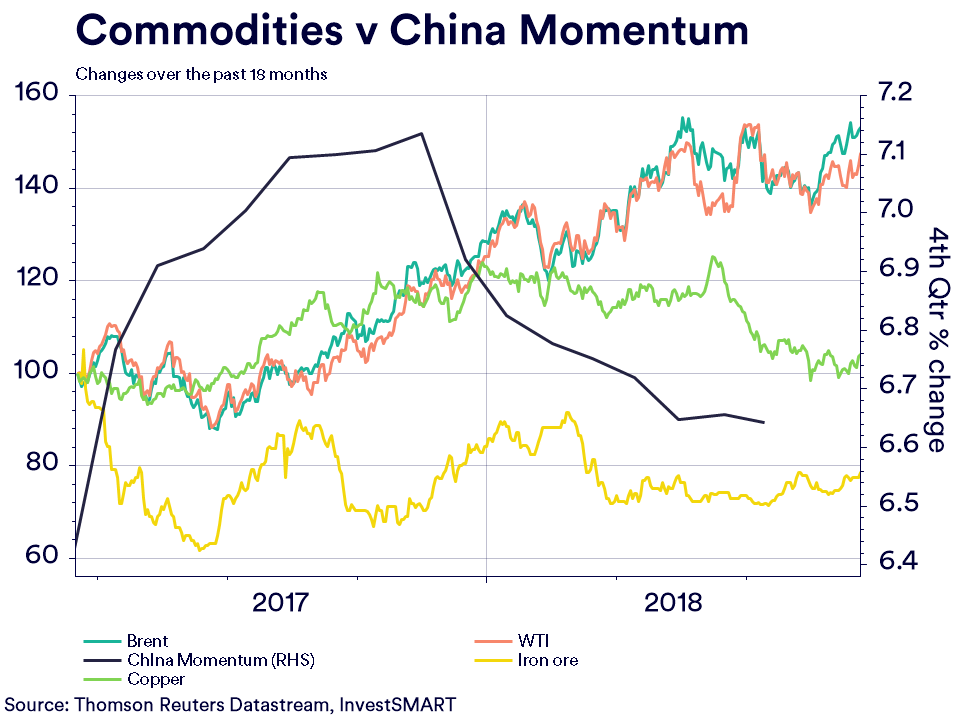

- The question is: has the US-China trade saga affected economic and financial indicators, such as markets, Chinese sentiment, trading and commodities? In short – yes it has, but it's not the only reason the Chinese economy has slowed in 2018.

-

Chinese momentum has actually been slowing since October last year. Although the US trade issues have done nothing to stop the fall, the chart above illustrates that China's financial stability programs initiated in late 2017 are more likely to be causing China's 2018 performance.

-

Copper has also reacted to the US-China situation, falling by as much as 16 per cent if we take the Chicago contract as a guide. However, it actually bounced this week once the final proposal was released. Copper remains a core indicator for Chinese growth, suggesting that by the next momentum gauge release, Chinese momentum will be even slower.

-

Interestingly, this week's geopolitical events actually saw a risk-on movement. The Dow and the S&P 500 reached new record-highs. They continue to be the investment bright spot, while emerging markets snapped back.

-

Finally, RBA Assistant Governor Chris Kent gave a brilliant speech this week regarding the creation of money. The funding and credit portion of the speech is a particular highlight. The full transcript can be found here.